Identification of Non-Financial Criteria Affecting Financial Performance in the Banking Industry

Keywords:

Criteria, Non-Financial, Financial Performance, BankingAbstract

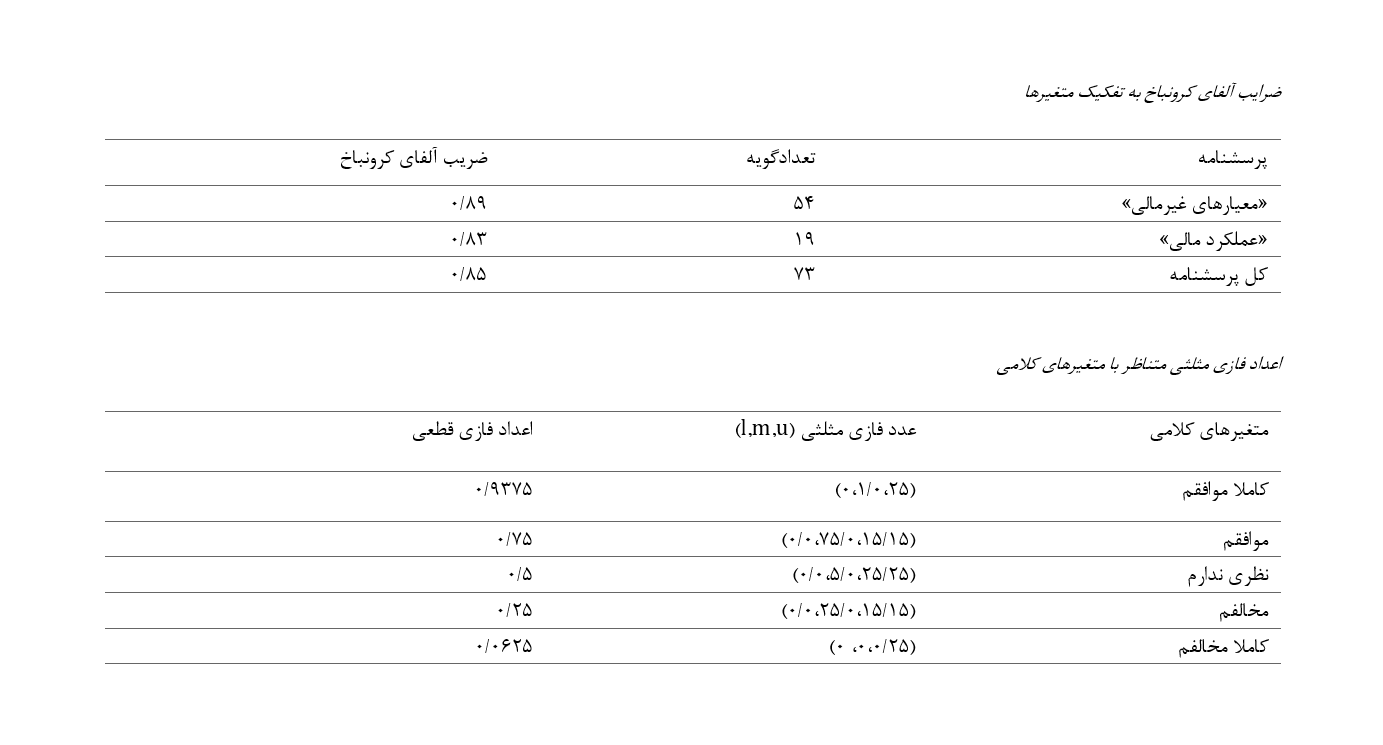

The objective of this study is to identify non-financial criteria that influence financial performance in the banking industry using a qualitative approach. The dimensions and indicators of non-financial criteria were identified through semi-structured interviews with academic experts selected purposefully. To validate the identified categories, the fuzzy Delphi technique was employed. The statistical population under investigation consisted of two groups: expert banking managers at various levels selected through purposive sampling based on the saturation rule (12 individuals), and university professors along with internal managers at different supervisory levels of banks listed on the Tehran Stock Exchange, from whom 10 individuals were selected based on the sample size requirement for the Delphi method. Data analysis in the qualitative phase was carried out using MAXQDA software. According to the findings, 54 indicators were categorized into six dimensions: individual, organizational, structural, developmental, procedural, and environmental factors. In the first round of the fuzzy Delphi technique, consensus was achieved for all six components. Moreover, the experts did not propose any new components beyond the initially suggested ones, and based on the final defuzzified means, the codes with the greatest impact within these six categories were identified. It can be concluded that financial criteria alone cannot sufficiently represent performance. Non-financial criteria serve as better indicators for reflecting future financial performance. Even when the primary objective is to maximize financial performance, traditional financial metrics contribute little to understanding long-term financial outcomes within an organization.

Downloads

References

Alrawashedh, N. H. (2024). Impact of Digital Transformation on the Organization’s Financial Performance: A Case of Jordanian Commercial Banks Listed on the Amman Stock Exchange. Banks and Bank Systems, 19(1), 126-134. https://doi.org/10.21511/bbs.19(1).2024.11

Amhana, Z. B. R., & Thomas, A. B. (2024). The Impact of Performance Appraisal on Employees' Productivity in Financial Institutions: A Case of the United States Banking Sector. European Journal of Business Startups and Open Society, 4(4), 270-282. http://www.inovatus.es/index.php/ejbsos/article/view/3055

Arora, S., & De, P. (2023). Enhancing bank performance through digital innovation: Insights from an emerging economy. Technological Forecasting and Social Change, 182, 121773. https://doi.org/10.1016/j.techfore.2022.121773

Barak, M., & Sharma, R. K. (2024). Does intellectual capital impact the financial performance of Indian public sector banks? An empirical analysis using GMM. Humanities and Social Sciences Communications, 11(1), 208. https://doi.org/10.1057/s41599-024-02702-5

Chatzopoulou, E., & Vlachvei, A. (2021). Customer relationship management and financial performance: The role of customer satisfaction in the Greek banking sector. Journal of Relationship Marketing, 20(1), 1-20. https://doi.org/10.1080/15332667.2020.1825085

Dalvand, V., Malek Akhlaq, A., & Dalvand, M. (2024). Analyzing the impact of social media on financial performance with the mediating role of social marketing in banks. Islamic Economics and Banking Quarterly, 50, 29-55. https://mieaoi.ir/browse.php?a_code=A-10-1500-1&sid=1&slc_lang=en

Gupta, A., & Arora, N. (2021). Exploring the impact of customer satisfaction on financial performance in Indian banking sector: A panel data analysis. Journal of Financial Services Marketing, 26(1), 15-24. https://doi.org/10.1057/s41264-020-00079-7

Hashemi, S. (2024). Investigating the impact of sustainability performance and governance on the financial performance of banks listed on the Tehran Stock Exchange. Seventh International Conference and Eighth National Conference on New Findings in Management, Psychology, and Accounting. https://civilica.com/doc/2284859/

Kim, D. H., & Kim, H. J. (2020). The role of employee engagement in enhancing customer satisfaction and financial performance in the banking sector. International Journal of Bank Marketing, 38(6), 1363-1379. https://doi.org/10.1108/IJBM-01-2020-0017

Lee, S., & Lee, J. (2023). The impact of innovation on the financial performance of banks: Evidence from emerging markets. Journal of Banking & Finance, 145, 106615. https://doi.org/10.1016/j.jbankfin.2023.106615

Lohano, R. (2024). The Influence of Digital Banking Services on Financial Performance: A Focus on Customer Experience. Progressive Research Journal of Arts & Humanities (Prjah), 6(1), 88-100. https://doi.org/10.51872/prjah.vol6.iss1.311

Martínez-Campillo, A., & Fernández-Sánchez, J. L. (2022). The effect of corporate social responsibility on customer loyalty and the mediating role of reputation in cooperative banking. Journal of Business Ethics, 171(3), 539-555. https://doi.org/10.1007/s10551-020-04461-3

Nguyen, H. T., & Simkin, L. (2022). The role of emotional intelligence in customer service excellence and financial performance in banks. Service Industries Journal, 42(5-6), 389-405. https://doi.org/10.1080/02642069.2022.1993968

Nizamuddin, M. (2024). Impact of Environmental, Social, and Governance Risk on the Financial Performance of Selected Indian Banks. Eatp, 6354-6364. https://doi.org/10.53555/kuey.v30i5.3944

Rezaee, Z., Doub, H., & Zhangc, H. (2019). Corporate Social Responsibility and Earnings Quality: Evidence from China. Global Finance Journal. https://doi.org/10.1016/j.gfj.2019.05.002

Sepidbar, Z., Mohammadzadeh, Y., & Nikpey Pesyan, V. (2024). Analysis of the effect of entrepreneurship index on employment in Iranian provinces: Spatial econometric approach. The Economic Research (Sustainable Growth and Development), 24(1), 285-311. https://doi.org/10.22034/24.1.285

Subedi, B., & Bhattarai, B. (2024). Green Banking and Perceived Financial Performance of Nepalese Commercial Banks. Open Journal of Business and Management, 12(03), 1912-1941. https://doi.org/10.4236/ojbm.2024.123102

Tan, Y., & Floros, C. (2021). Corporate social responsibility and financial performance in the banking industry: The role of customer satisfaction. Corporate Governance: The International Journal of Business in Society, 21(6), 1152-1168. https://doi.org/10.1108/CG-11-2020-0470

Temba, G. I., Kasoga, P. S., & Keregero, C. M. (2024). Impact of the quality of credit risk management practices on financial performance of commercial banks in Tanzania. SN Business & Economics, 4(3), 38. https://doi.org/10.1007/s43546-024-00636-3

Yousefi Qaleh Roudkhani, M. A., Tehrani, R., & Mirlohi, S. M. (2023). The relationship between financial performance and financial stability of banks listed on the Tehran Stock Exchange and Iran's over-the-counter market. Stock Exchange Journal, 16, 62.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Mahdieh Taboli; Iraj Noravesh (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.