The Performance of Momentum and Reversal Strategies Under Conditions of Financial Stress and No Financial Stress

Keywords:

financial stress, strategy, momentum, reversalAbstract

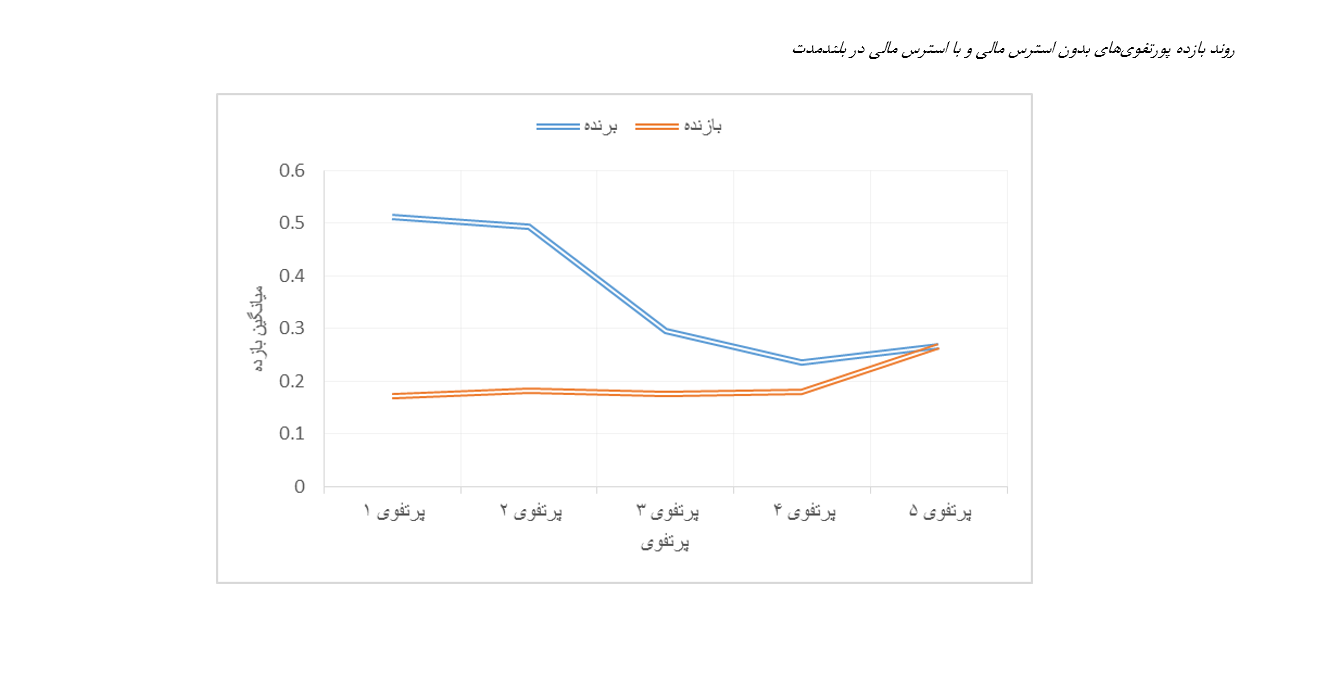

In the financial market, two key indicators, risk and return, play a determining role in the investment decisions of various companies. Investors seek to choose options that offer maximum returns with minimal risk, and they aim to apply strategies to achieve excess returns and outperform the market. One of the important and widely used strategies among investors for selecting an optimal portfolio in financial markets is the momentum strategy. Therefore, the present study investigates the performance of momentum and reversal strategies under conditions of financial stress and no financial stress. In this regard, to compare the performance of the momentum strategy under conditions of no financial stress in both the short and long term, a paired t-test was used. The statistical hypothesis related to this part showed that if the cumulative abnormal return for the arbitrage portfolio is positive, purchasing stocks without financial stress in the short term and selling stocks without financial stress in the long term can generate positive abnormal returns. The results of the hypothesis testing showed that in all cases, except for the fifth portfolio, the significance level was smaller than the test level. In other words, for the first, third, and fourth portfolios, it can be claimed with high confidence that using the momentum strategy and purchasing stocks without financial stress in the short term and selling stocks without financial stress in the long term can generate positive returns. On the other hand, for the second portfolio, it can be claimed that using the momentum strategy and selling stocks without financial stress in the short term and purchasing stocks without financial stress in the long term can generate positive returns.

Downloads

References

Carvalho, L. (2024). Socially Responsible Investment Funds—An Analysis Applied to Funds Domiciled in the Portuguese and

Spanish Markets. Risks, 12(1), 9. https://doi.org/10.3390/risks12010009

Chang, R. P., Ko, K. C., Nakano, S., & Rhee, S. G. (2018). Residual momentum in Japan. Journal of Empirical Finance, 45,

-299. https://doi.org/10.1016/j.jempfin.2017.11.005

Dargahi, H., & Nikjoo, F. (2012). Constructing a Financial Stress Index for Iran's Economy and Examining Its Effects on

Economic Growth. Economic Research, 19(40). https://jte.ut.ac.ir/article_30191.html

Devajit, M., & Haradhan Kumar, M. (2022). Development of Grounded Theory in Social Sciences: A Qualitative Approach.

Studies in Social Science & Humanities, 1(5), 13-24. https://www.paradigmpress.org/SSSH/article/view/342

Doulou, M., & Javadian, B. (2017). Momentum of '52-Week High Timing': Evidence from Tehran Stock Exchange. Financial

Studies of Securities Analysis, 10(35). https://journals.srbiau.ac.ir/article_10664.html

Fromlet, H. (2001). Behavioral finance theory and practical application. Business Economics, 36.

Hasanzadeh, I., Sheikh, M. J., Arabzadeh, M., & Farzinfar, A. A. (2023). The Role of Economic Policy Uncertainty in Relation

to Financial Market Instability and Stock Liquidity in Tehran Stock Exchange Companies. Dynamic Management and

Business Analysis, 2(3), 163-178. https://doi.org/10.22034/dmbaj.2024.2031971.2315

Lin, Q. (2018). Residual momentum and the cross-section of stock returns: Chinese evidence. Finance Research Letters.

https://doi.org/10.1016/j.frl.2018.07.009

Mishkin, F. (2000). Inflation Targeting in Emerging Market Countries (Working Paper, Issue.

Mohammadi Komroudi, M. J., Ahmadi, M., & Farhadi Mahalli, A. (2024). Designing an Ethically-Oriented Management

Model for Employee Education Development in Higher Education Using Grounded Theory (Case Study: Free Universities

of Mazandaran Province) [Research Article]. Iranian Journal of Educational Sociology, 7(2), 114-123.

https://doi.org/10.61838/kman.ijes.7.2.14

Mousavi Shiri, M., Salehi, M., Shakeri, M., & Bakhshian, A. (2015). Profitability of Momentum Strategy and the Impact of

Stock Trading Volume on It in Tehran Stock Exchange. Financial Engineering and Securities Management Quarterly,

(25), 107-124. https://www.sid.ir/paper/197673/fa

Nevins, D. (2001). Goals based investing: Integrating traditional and behavioral finance. Business Economics, 4.

Norouzi, H., & Khalili Araki, M. (2018). Momentum Strategies and Emotional Tendencies of Investors in Real Estate

Investment Companies Listed on Tehran Stock Exchange. Financial Management Strategy Quarterly, 6(22), 167-188.

http://ensani.ir/fa/article/388247/%D8%A7%D8%B3%D8%AA%D8%B1%D8%A7%D8%AA%DA%98%DB%8C-

%D9%87%D8%A7%DB%8C-%D8%B4%D8%AA%D8%A7%D8%A8-%D9%88-

%D8%AA%D9%85%D8%A7%DB%8C%D9%84%D8%A7%D8%AA-

%D8%A7%D8%AD%D8%B3%D8%A7%D8%B3%DB%8C-

%D8%B3%D8%B1%D9%85%D8%A7%DB%8C%D9%87-

%DA%AF%D8%B0%D8%A7%D8%B1%D8%A7%D9%86-%D8%AF%D8%B1-

%D8%B4%D8%B1%DA%A9%D8%AA-%D9%87%D8%A7%DB%8C-

%D8%B3%D8%B1%D9%85%D8%A7%DB%8C%D9%87-%DA%AF%D8%B0%D8%A7%D8%B1%DB%8C-

%D8%A7%D9%85%D9%84%D8%A7%DA%A9-%D9%88-

%D9%85%D8%B3%D8%AA%D8%BA%D9%84%D8%A7%D8%AA-

%D9%BE%D8%B0%DB%8C%D8%B1%D9%81%D8%AA%D9%87-%D8%B4%D8%AF%D9%87-

%D8%AF%D8%B1-%D8%A8%D9%88%D8%B1%D8%B3-%D8%A7%D9%88%D8%B1%D8%A7%D9%82-

%D8%A8%D9%87%D8%A7%D8%AF%D8%A7%D8%B1

Pishbahar, E. (2018). Econometrics (with applications of econometrics-specific software). Noor Elm.

https://ajansbook.ir/%DA%A9%D8%AA%D8%A7%D8%A8-

%D8%A7%D9%82%D8%AA%D8%B5%D8%A7%D8%AF%D8%B3%D9%86%D8%AC%DB%8C-

%D8%AC%D9%84%D8%AF-%D8%A7%D9%88%D9%84-%D9%87%D9%85%D8%B1%D8%A7%D9%87-

%D8%A8%D8%A7-%DA%A9%D8%A7%D8%B1%D8%A8%D8%B1%D8%AF-%D9%86%D8%B1%D9%85-

%D8%A7%D9%81%D8%B2%D8%A7%D8%B1%D9%87%D8%A7%DB%8C-

%D9%88%DB%8C%DA%98%D9%87-

%D8%A7%D9%82%D8%AA%D8%B5%D8%A7%D8%AF%D8%B3%D9%86%D8%AC%DB%8C

Rahimi, M., Bahmaee, L., & Barekat, G. H. (2023). Designing A Paradigmatic Model of Barriers to Innovation Management

in Ahvaz Primary Schools. International Journal of Innovation Management and Organizational Behavior (IJIMOB),

(4), 19-27. https://doi.org/10.61838/kman.ijimob.3.4.3

Safari, A., & Ashna, M. (2019). Providing an Optimal Model for Stock Selection Based on Momentum Trading Strategy.

Scientific-Research Quarterly of Financial Knowledge and Securities Analysis, 12(41).

https://www.sid.ir/paper/200180/fa

Shawn, L. K. J., Dawel, D. L., Weijie, M., & Benjamin, P. (2013). Testing the profitability of a volume-Augmented Momentum

Strategy in the Philippines Equity Market. Journal of Applied Finance & Banking, 3, 1-12.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.