The Strategic Renewal Model of Organizations Under Environmental Uncertainty (Case Study: Startup Organizations in the Payment Industry)

Keywords:

Uncertainty, Strategic Renewal, Startup Organizations, Payment Industry, FinTech SectorAbstract

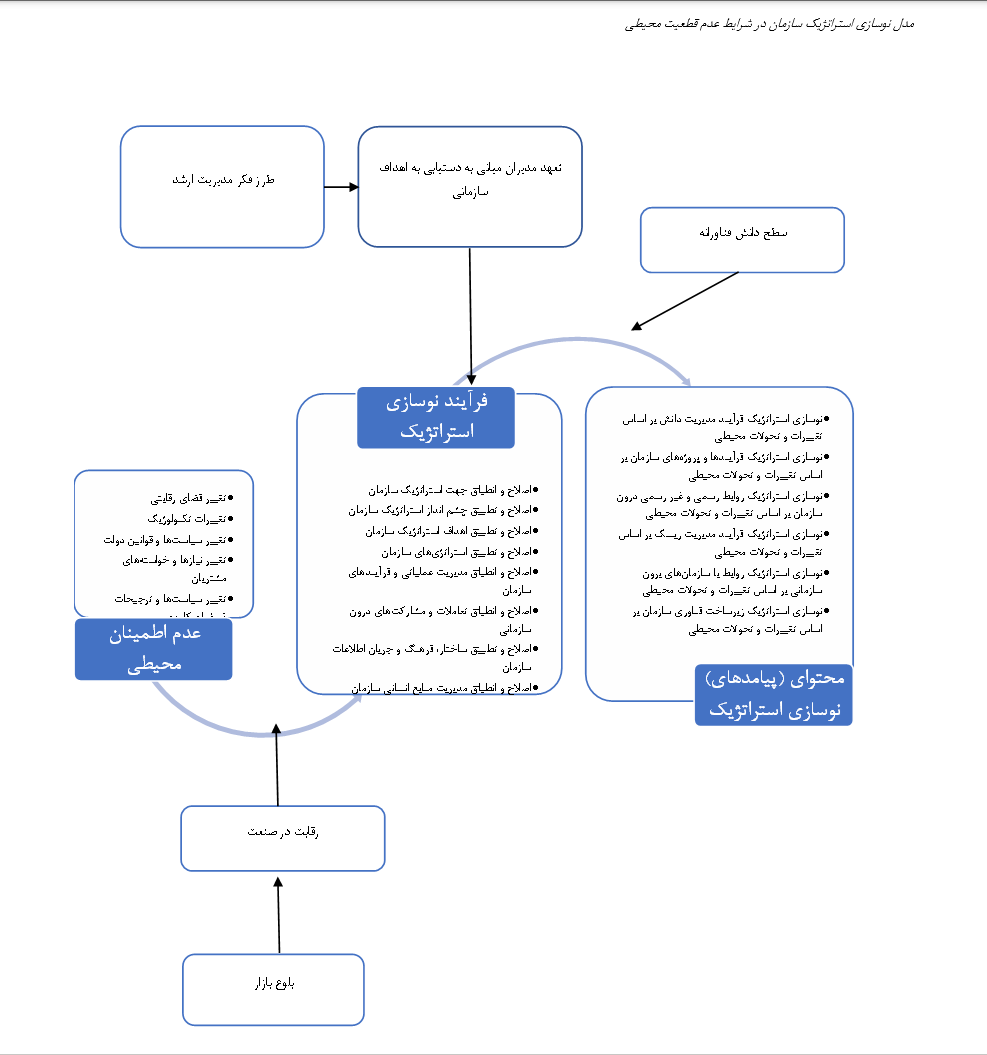

The concept of strategy is intertwined with environmental uncertainty. In fact, strategic management can be seen as a systematic approach to dealing with environmental turbulence and changes, ultimately ensuring business success and preventing the negative consequences of environmental changes in business. Therefore, many researchers and managers seek solutions to reduce the impact of uncertainty in order to make effective strategic decisions. Among the various methods that managers choose to manage environmental uncertainty, strategic renewal is considered one of the most effective approaches. Some businesses, such as payment startups, face greater environmental uncertainties due to the nascent nature of the industry on one hand and the nascent state of the organization on the other. The strategic management literature does not provide a comprehensive solution for the strategic renewal of nascent businesses. Hence, this study, using the case study research method and focusing on an active startup in the payment industry, aims to propose a model for the strategic renewal of payment startups operating in environments with high uncertainty. This research revealed that among environmental factors, certain factors lead to increased environmental uncertainty for startup businesses. Additionally, in this model, the components of the strategic renewal process, as well as the outcomes and consequences of implementing strategic renewal in these businesses, have been identified.

Downloads

References

Anshari, M., Almunawar, M. N., & Masri, M. (2019). An Overview of Financial Technology in Indonesia. In Financial

Technology and Disruptive Innovation in ASEAN (pp. 216-224). IGI Global. https://doi.org/10.4018/978-1-5225-

-2.ch012

Arner, D. W., Barberis, J., & Buckey, R. P. (2016). FinTech, RegTech, and the reconceptualization of financial

regulation. Northwestern Journal of International Law & Business, 37(3), 371-394. https://www.mdpi.com/2071-

/12/19/8035

Asadi Ghanbari, A., Salamati Taba, S. S., Daneshgar, S. A., & Heydari, F. (2016). Fintechs or Opportunities and Their

Role in the Future of Banking Proceedings of the 6th National Conference on Electronic Banking and Payment

Systems, Tehran. https://civilica.com/doc/785642/

Asadollah, M., Sanavi Fard, R., & Hamidi Zadeh, A. (2019). Business Model of Electronic Banking Based on the

Emergence of Fintechs and Financial Startups. Technology Development Management, 7(2), 248-195.

https://jtdm.irost.ir/article_854.html

Chen, X., Yu, X., & Chang, V. (2021). FinTech and commercial banks' performance in China: A leap forward or survival

of the fittest? Technological Forecasting & Social Change. https://doi.org/10.1016/j.techfore.2021.120645

Cheng, M., & Qu, Y. (2020). Does bank FinTech reduce credit risk? Evidence from China. Pacific-Basin Finance

Journal. https://doi.org/10.1016/j.pacfin.2020.101398

Chuen, K., & Lee, D. (2017). Fintech tsunami: Blockchain as the driver of the Fourth Industrial Revolution.

Lyons, A. C., Kass-Hanna, J., & Fava, A. (2020). Fintech development and savings, borrowing, and remittances: A

comparative study of emerging economies. Emerging Markets Review. https://doi.org/10.2139/ssrn.3689142

Moretti, D. M., Alves, F. C., & Bomtempo, J. V. (2020). Entrepreneurial-oriented strategic renewal in a Brazilian SME:

A case study. Journal of Small Business and Enterprise Development, 27(2), 219-236.

https://doi.org/10.1108/JSBED-07-2019-0254

Najafi, F., Irandoost, M., Soltan Panah, H., & Sheikh Ahmadi, A. (2019). Designing a Model for Managing the

Relationship between the Banking Industry of Iran and Fintechs and Fintech Startups with a Grounded Theory

Approach. Business Strategies Journal, 12(19), 12-11. https://cs.shahed.ac.ir/article_2418.html

Pettit, K. L., & Crossan, M. M. (2019). Strategic renewal: Beyond the functional resource role of occupational members.

Strategic management journal, 41(6), 1112-1138. https://doi.org/10.1002/smj.3115

Rohani Rad, S. (2015). Fintech; An Exploration of the World and Iran. Journal of Science and Technology, 11(1), 27-

https://www.sid.ir/paper/361610/fa

Shu, C., De Clercq, D., Zhou, Y., & Liu, C. (2019). Government institutional support, entrepreneurial orientation,

strategic renewal, and firm performance in transitional China. International Journal of Entrepreneurial Behavior &

Research, 25(3), 433-456. https://doi.org/10.1108/IJEBR-07-2018-0465

Wiegner, B. (2016). Financial management for innovation fintech-start-ups vs. usual companies.

https://doi.org/10.2139/ssrn.2883994

Wijaya Kusuma, G., & Sudhartio, L. (2020). The impact of strategic renewal in banking industry performance.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 1403 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.