Designing a Credit Risk Management Model with a Focus on Collateral and Guarantees of Bank Loans

Keywords:

Credit Risk Management, Collaterals and Guarantees of Bank Loans, Interpretive Structural Modeling (ISM)Abstract

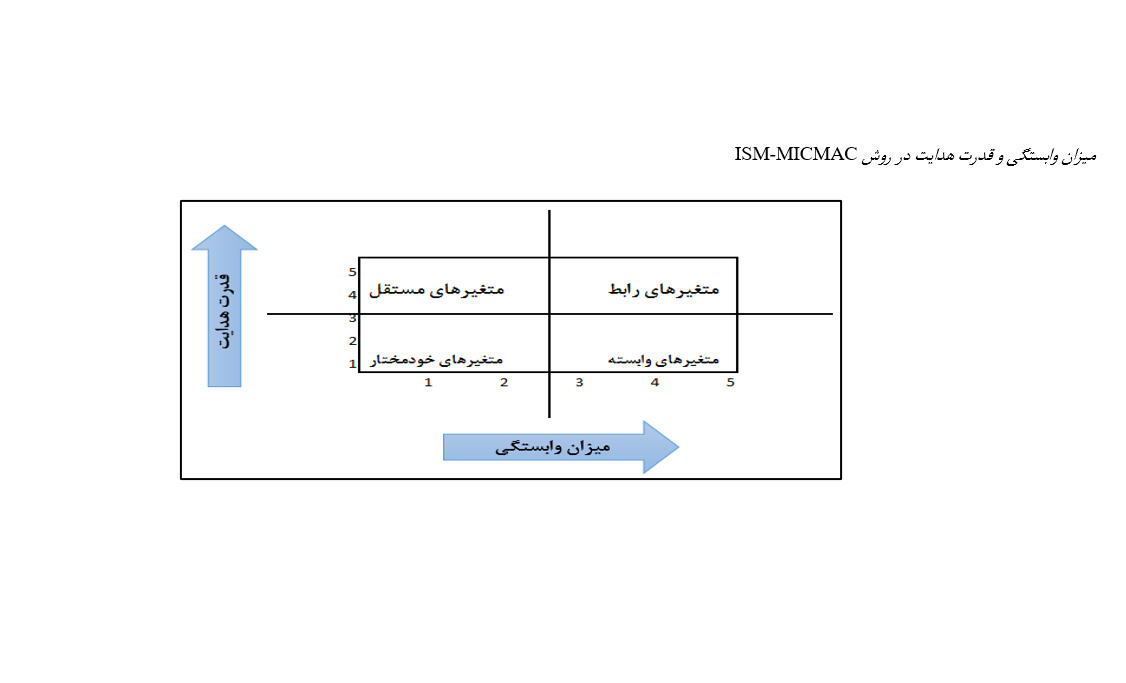

Banks, due to their role in financial intermediation, have a significant impact on the economic and social development of countries. However, they are always exposed to risks such as credit risk, which requires effective management. Weakness in managing this type of risk can cause irreparable losses and even lead to bankruptcy. Identifying factors that reduce and control this risk plays a key role in the success of risk management. This study focuses on collateral and guarantees in bank loans, examining the factors influencing credit risk management. The research method is a mixed approach (qualitative-quantitative), and Bank Keshavarzi was selected as the case study. In the qualitative section, the factors were extracted through meta-synthesis and evaluated using the fuzzy Delphi screening technique. The statistical population included university professors, managers, and senior credit experts from the bank, who were selected purposefully. In the quantitative section, the relationships between factors were analyzed using a combination of Interpretive Structural Modeling (ISM) and MICMAC analysis in a fuzzy environment. The results indicated that 34 criteria were classified into four main categories and seven levels. Among these factors, the bank's high credit committee and the collateral seizure process were identified as the main foundations of credit risk management. MICMAC analysis revealed that these two factors, along with interest rate fluctuations and currency exchange rates, had a high impact and played an independent role in credit policy-making. These findings emphasize the importance of legal frameworks and macro-level decision-making in credit risk management and provide a significant guide for policymakers.

Downloads

References

Abdesslem, R. B., Chkir, I., & Dabbou, H. (2022). Is managerial ability a moderator? The effect of credit risk and liquidity risk on the likelihood of bank default. International Review of Financial Analysis, 80, 102044. https://doi.org/10.1016/j.irfa.2022.102044

Akbarian, S., Anvari Rostami, R., & Abdi. (2021). The Impact of Social Performance Indicators on Credit Risk in the Banking Industry. Investment Knowledge. https://sanad.iau.ir/Journal/jik/Article/843021/FullText

Alrfai, M. M., Salleh, D. B., & Waemustafa, W. (2022). Empirical examination of credit risk determinant of commercial banks in Jordan. Risks, 10(4), 85. https://doi.org/10.3390/risks10040085

Benmelech, E., & Bergman, N. K. (2009). Collateral pricing. Journal of Financial Economics, 91(3), 339-360. https://doi.org/10.1016/j.jfineco.2008.03.003

Bessis, J. (2011). Risk management in banking. John Wiley & Sons. http://ndl.ethernet.edu.et/bitstream/123456789/34299/1/205.Jo%C3%ABl%20Bessis.pdf

Choi, D. B., Santos, J. A., & Yorulmazer, T. (2021). A theory of collateral for the lender of last resort. Review of Finance, 25(4), 973-996. https://doi.org/10.1093/rof/rfab002

Colquitt, J. (2021). Credit risk management. McGraw-Hill. https://www.lehmanns.de/shop/wirtschaft/7890924-9780071446600-credit-risk-management

Cressy, R., & Toivanen, O. (2001). Is there adverse selection in the credit market? Venture Capital: An International Journal of Entrepreneurial Finance, 3(3), 215-238. https://doi.org/10.1080/13691060110052104

Djebali, N., & Zaghdoudi, K. (2020). Threshold effects of liquidity risk and credit risk on bank stability in the MENA region. Journal of Policy Modeling, 42(5), 1049-1063. https://doi.org/10.1016/j.jpolmod.2020.01.013

Gudde Jote, G. (2018). Determinants of Loan Repayment: The Case of Microfinance Institutions in Gedeo Zone, SNNPRS, Ethiopia. Universal Journal of Accounting and Finance, 6(3), 108-122. https://doi.org/10.13189/ujaf.2018.060303

Gupta, C. P., & Jain, A. (2022). A study of banks' systemic importance and moral hazard behaviour: A panel threshold regression approach. Journal of Risk and Financial Management, 15(11), 537. https://doi.org/10.3390/jrfm15110537

Islam, M. N. (2020). The impact of board composition and activity on non-performing loans. https://thekeep.eiu.edu/cgi/viewcontent.cgi?article=1002&context=lib_awards_2020_docs

Krasniqi, B., Kotorri, M., & Aliu, F. (2023). Relationship banking, collateral, and the economic crisis as determinants of credit risk: an empirical investigation of SMEs. The South East European Journal of Economics and Business, 18(2), 49-62. https://doi.org/10.2478/jeb-2023-0018

Naili, M., & Lahrichi, Y. (2022). The determinants of banks' credit risk: Review of the literature and future research agenda. International Journal of Finance & Economics, 27(1), 334-360. https://doi.org/10.1002/ijfe.2156

Natufe, O. K., & Evbayiro-Osagie, E. I. (2023). Credit risk management and the financial performance of deposit money banks: some new evidence. Journal of Risk and Financial Management, 16(7), 302. https://doi.org/10.3390/jrfm16070302

Nguyen, Q. K. (2022). The impact of risk governance structure on bank risk management effectiveness: Evidence from ASEAN countries. Heliyon, 8(10). https://doi.org/10.1016/j.heliyon.2022.e11192

Roshan, M., & Khodarahmi, S. (2024). Measuring Credit Risk and Capital Adequacy Considering the Size and Ownership Structure of Listed Banks in Iran Based on the Generalized Method of Moments (GMM) Panel Model. Management Accounting and Auditing Knowledge, 14(54), 313-329. https://www.jmaak.ir/article_23582.html

Sengupta, R. (2014). Lending to uncreditworthy borrowers. Journal of Financial Intermediation, 23(1), 101-128. https://doi.org/10.1016/j.jfi.2013.07.001

Siddique, A., Khan, M. A., & Khan, Z. (2022). The effect of credit risk management and bank-specific factors on the financial performance of the South Asian commercial banks. Asian Journal of Accounting Research, 7(2), 182-194. https://doi.org/10.1108/AJAR-08-2020-0071

Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. The American economic review, 71(3), 393-410. https://www.jstor.org/stable/1802787

Taheri, Z., & Ghorooei, A. (2022). Prioritizing Inefficiency Criteria of National Bank Branches in Iran. Financial Economics, 16(60), 213-236. https://journals.iau.ir/article_697612.html

Varga Kiss, K. (2016). Risk management strategies of financial institutions in Hungary. Studia Ekonomiczne(284), 172-186. https://bibliotekanauki.pl/articles/589016

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.