Evaluation of the Role of Artificial Intelligence Tools in the Development of Financial Services and Marketing

Keywords:

Artificial Intelligence, Financial Services, MarketingAbstract

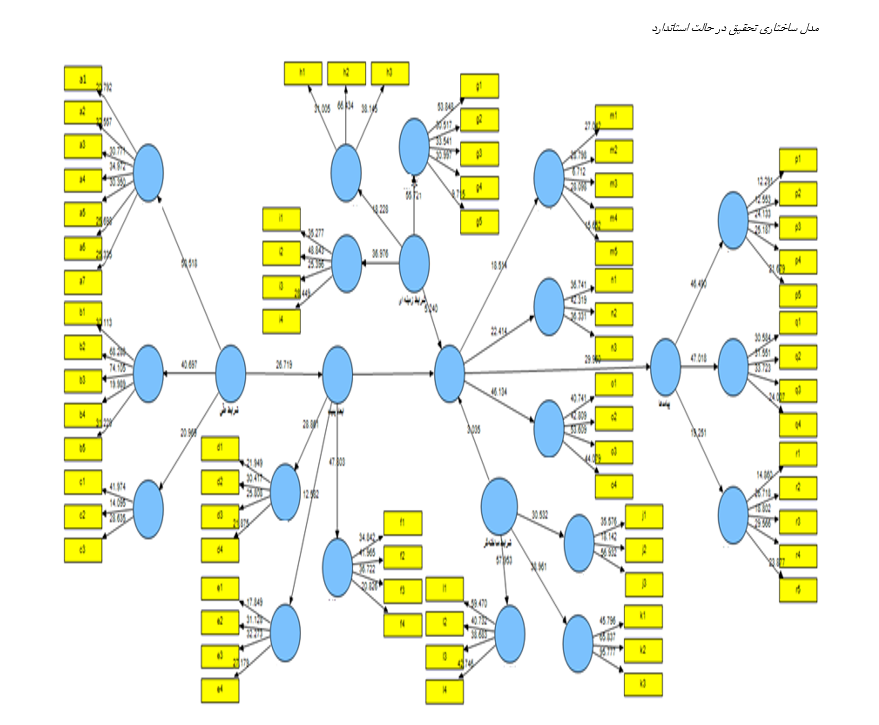

Artificial intelligence (AI), as one of the transformative technologies, has had a significant impact on the development of financial services and marketing. In the financial services sector, these tools enhance productivity and security by analyzing vast amounts of data, managing risk, preventing fraud, and offering personalized services. In marketing, AI improves customer experience and campaign effectiveness through customer behavior analysis, targeted campaign design, and process automation. Additionally, the integration of financial and marketing data via AI creates a seamless experience for customers and optimizes costs. Despite challenges such as privacy protection and implementation costs, solutions like formulating transparent data policies, training human resources, and investing in infrastructure can ensure the success of these tools. This study aims to evaluate the role of AI tools in the development of financial services. The statistical population of this research consists of all financial and marketing managers. The necessary data was collected through a questionnaire from 86 managers and staff members of financial and marketing departments in knowledge-based companies in Tehran, who were selected using non-probability, simple, and convenient sampling methods. Partial Least Squares (PLS) method and SAMART-PLS software were used to test the model. The evaluation results indicate that AI tools are capable of processing and analyzing large datasets, leading to more accurate decision-making in financial services (such as customer credit assessment) and marketing (such as customer behavior analysis). Despite challenges such as implementation costs and privacy issues, the intelligent use of these technologies can bring about a dramatic transformation in organizational performance and competitiveness.

Downloads

References

Alizadeh, H., Tayebi Niaraki, M., Dezfolian, M., & Yekta, H. (2019). Evaluation of the role of internal branding on the

effectiveness of the brand value of Iran Insurance Company. Scientific Journal of New Research Approaches in

Management and Accounting, 3(8), 134-149. https://majournal.ir/index.php/ma/article/view/153

Alizadeh, H., Tayebi Niaraki, M., Yekta, H., & Romeyani, S. (2019). Evaluating the effect of brand identity on performance

through the mediating role of customer relationship management. Scientific Journal of New Research Approaches in

Management and Accounting, 3(8), 134-149. https://majournal.ir/index.php/ma/article/view/187

Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of

Economic Perspectives, 29(2), 213-238. https://doi.org/10.1257/jep.29.2.213

Gao, Y., & Liu, H. (2022). Artificial Intelligence-Enabled Personalization in Interactive Marketing: A Customer Journey

Perspective. Journal of Research in Interactive Marketing, 17(5), 663-680. https://doi.org/10.1108/jrim-01-2022-0023

Guha, A., Breßgott, T., Grewal, D., Mahr, D., Wetzels, M., & Schweiger, E. B. (2022). How Artificiality and Intelligence

Affect Voice Assistant Evaluations. Journal of the Academy of Marketing Science. https://doi.org/10.1007/s11747-022-

-7

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1-16.

https://doi.org/10.1016/j.jbusvent.2013.06.005

Rachinger, M., Rauter, R., Muller, C., Vorraber, W., & Schirgi, E. (2019). Digitalization and its influence on business model

innovation. Journal of Manufacturing Technology Management, 30(8), 1143-1160. https://doi.org/10.1108/JMTM-01-

-0020

Roma, P., Petruzzelli, A. M., & Perrone, G. (2017). From the crowd to the market: The role of reward-based crowdfunding

performance in attracting professional investors. Research Policy, 46(9), 1606-1628.

https://doi.org/10.1016/j.respol.2017.07.012

Stanko, M. A., & Henard, D. H. (2017). Toward a better understanding of crowdfunding, openness and the consequences for

innovation. Research Policy, 46(4), 784-798. https://doi.org/10.1016/j.respol.2017.02.003

Vochozka, M., Kliestik, T., Kliestikova, J., & Sion, G. J. E. (2018). Participating in a highly automated society: how artificial

intelligence disrupts the job market. Economics, Management, and Financial Markets, 13(4), 57-62.

https://doi.org/10.22381/EMFM13420185

Wamba-Taguimdje, S. L., Fosso Wamba, S., Kala Kamdjoug, J. R., & Tchatchouang Wanko, C. E. (2020). Influence of

artificial intelligence (AI) on firm performance: the business value of AI-based transformation projects. Business Process

Management Journal, 26(7), 1893-1924. https://doi.org/10.1108/BPMJ-10-2019-0411

Wu, C. W., & Monfort, A. (2022). Role of Artificial Intelligence in Marketing Strategies and Performance. Psychology and

Marketing, 40(3), 484-496. https://doi.org/10.1002/mar.21737

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) -1 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.