Identification and Analysis of Key Factors Influencing Customer Behavior Patterns in the Banking System

Keywords:

Behavior patterns, banking system customers, thematic analysis, Day Bank branchesAbstract

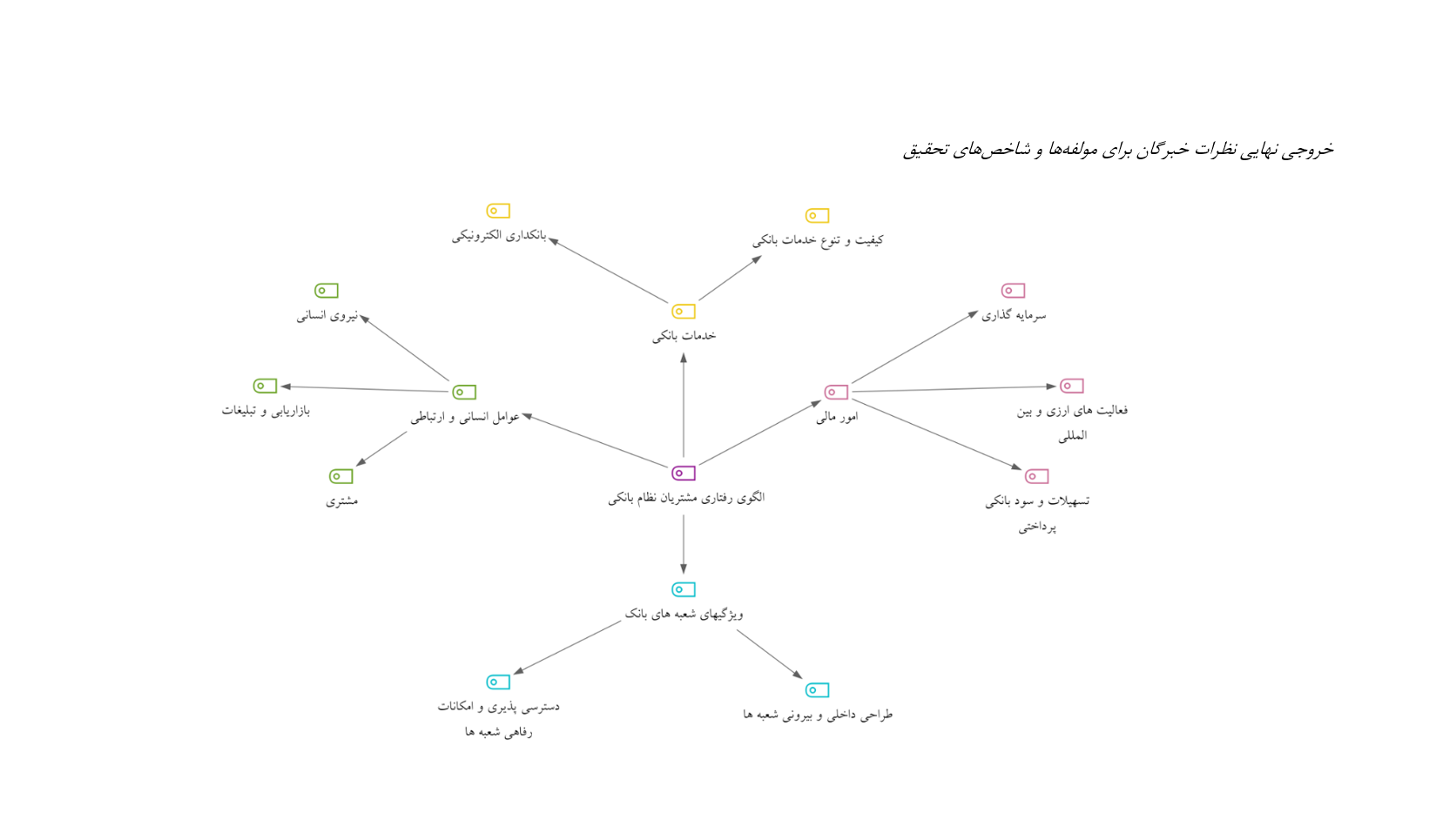

The aim of this study is to examine, identify, and analyze the key factors influencing customer behavior patterns in the banking system. This research was conducted using a qualitative approach and thematic analysis. Data collection and extraction of relevant themes were carried out through semi-structured interviews with key experts in this field. Participants were selected using purposive sampling and the criterion of theoretical saturation, based on which 12 individuals were chosen, including university professors in the fields of marketing management and business, as well as heads, deputies, and customer relationship managers from Day Bank branches in Tehran. To ensure the validity and reliability of the data, two methods were employed: participant review and expert review by non-participating experts in the research. For data analysis, MAXQDA statistical software was used, and the data were examined through thematic analysis. The results of this study indicate that customer behavior patterns in the banking system are structured into four main categories (banking services, financial affairs, branch characteristics, and human and relational factors), 10 subcategories (electronic banking, quality and variety of banking services, foreign exchange and international activities, banking facilities and interest rates, investments, interior and exterior branch design, branch accessibility and amenities, customers, human resources, marketing and advertising), and 66 indicators.

Downloads

References

Alfian, G., Ijaz, M. F., Syafrudin, M., Syaekhoni, M. A., Fitriyani, N. L., & Rhee, J. (2019). Customer behavior analysis

using real-time data processing: A case study of digital signage-based online stores. Asia Pacific Journal of

Marketing and Logistics. https://doi.org/10.1108/APJML-03-2018-0088

Amin, A., Al-Obeidat, F., Shah, B., Adnan, A., Loo, J., & Anwar, S. (2019). Customer churn prediction in

telecommunication industry using data certainty. Journal of Business Research, 94, 290-301.

https://doi.org/10.1016/j.jbusres.2018.03.003

Ansari, A., Kheib, S. N., Siaber, Z., & Timouri, H. (2015). Study of the Relationship Between Satisfaction, Loyalty, and

Customer Willingness to Change Brands in Service Organizations Considering the Moderating Role of Customer

Variety-Seeking and Involvement in Purchase Intentions. Modern Marketing Research, 5(2), 211-224.

https://ecc.isc.ac/showJournal/22424/64597/821722

Arsanjani, A. A. (2020). Designing a Model for Electronic Banking Business in Iran Azad University, Rasht Branch].

https://jed.ut.ac.ir/article_83501.html

Asokan, G., & Mohanavalli, S. (2011). Fuzzy clustering for effective customer relationship management in telecom

industry.International Conference on Computational Science, Engineering and Information Technology

Bakar, J. A., & Adzis, A. A. (2024). Fostering Loyalty Among Young Consumers: Strategic Approaches for Bank

Sustainability. International Journal of Professional Business Review, 9(3), e04469.

https://doi.org/10.26668/businessreview/2024.v9i3.4469

Calzada-Infante, L., Óskarsdóttir, M., & Baesens, B. (2020). Evaluation of customer behavior with temporal centrality

metrics for churn prediction of prepaid contracts. Expert Systems with Applications, 160, 113553.

https://doi.org/10.1016/j.eswa.2020.113553

Dubina, O., Us, Y., Pimonenko, T., & Lyulyov, O. (2020). Customer loyalty to bank services: The bibliometric analysis.

Virtual Economics, 3(3), 53-66. https://doi.org/10.34021/ve.2020.03.03(3)

Ehghaghi, H. R., Qasemi, M., & Hosseinzadeh, A. (2021). Examining Factors Affecting Customer Loyalty with a Focus

on Brand Personality. Ethical Researches, 12(2), 37-60. https://rimag.ir/en/Article/32359/FullText

Ferdoshadeh, M. (2017). Optimizing Customer Validation in Electronic Banking Using Data Mining Methods Kavosh

Higher Education Institute]. https://civilica.com/doc/758832/

Gautam, D. K., & Sah, G. K. (2023). Online banking service practices and its impact on e-customer satisfaction and ecustomer loyalty in developing country of South Asia-Nepal. Sage Open, 13(3), 21582440231185580.

https://doi.org/10.1177/21582440231185580

Gharib, I., Tolouei, A., Heydarzadeh, K., & Varadfar, R. (2018). Identifying Dominant Customer Behavior Patterns Over

Time Across Various Sections; Case Study: Ansar Bank. Modern Marketing Research, 8(4), 150-165.

https://sid.ir/fa/journal/ViewPaper.aspx?ID=489531

Gharib, I., Tolouei Ashlaghi, A., & Heydarzadeh, K. (2019). Providing a Combined Data Mining Model Using

Association Rules and Clustering for Identifying Dominant Customer Behavior Patterns (Case Study: Ansar Bank).

Management Future Research (Management Studies), 30(11), 189-202.

https://www.sid.ir/fa/journal/ViewPaper.aspx?id=491953

Ho, S. C., Wong, K. C., Yau, Y. K., & Yip, C. K. (2019). A machine learning approach for predicting bank customer

behavior in the banking industry.Machine Learning and Cognitive Science Applications in Cyber Security

Homburg, C., Lauer, K., & Vomberg, A. (2019). The multichannel pricing dilemma: Do consumers accept higher offline

than online prices? International Journal of Research in Marketing, 36(4), 597-612.

https://doi.org/10.1016/j.ijresmar.2019.01.006

Kalinin, A., Vaganov, D., & Bochenina, K. (2020). Discovering patterns of customer financial behavior using social

media data. Social Network Analysis and Mining, 10(1), 77. https://doi.org/10.1007/s13278-020-00690-3

Khodabandehlou, S., & Rahman, M. Z. (2017). Comparison of supervised machine learning techniques for customer

churn prediction based on analysis of customer behavior. Journal of Systems and Information Technology.

https://doi.org/10.1108/JSIT-10-2016-0061

Malek Akhlagh, I., Mohammadi, Y., & Talebi, D. (2021). Designing a Model of Banking Customer Behavior in Social

Media. Business Management Explorations, 13(25), 475-497. https://bar.yazd.ac.ir/m/article_2424.html?lang=en

Maulana, I., Basri, Y. Z., & Mariyati, T. (2022). Factors Affecting the Customer Loyalty of Sharia Rural Bank.

Amwaluna: Jurnal Ekonomi dan Keuangan Syariah, 6(2), 340-361. https://doi.org/10.29313/amwaluna.v6i2.10038

Nourizadeh, M., Nourbakhsh, K., & Haqshenas, F. (2023). Designing a Dual-Dimensional Model of Customer Loyalty

for Electronic Banking Services. Consumer Behavior Studies, 10(2), 113-137.

https://cbs.uok.ac.ir/article_62705.html?lang=en

Paridari, M., Saberi, H., Amini, Z. a.-A., & Sadeh, E. (2020). Identifying and Analyzing Behavioral Patterns of Bank

Service Customers Using Data Mining Techniques. Iranian Political Sociology, 3(3), 3452-3471.

Pourvahidi, F., Abolfazli, S. A., Rezvani, M., & Mirsafasi, N. (2022). Designing a Model of Factors Affecting Customer

Citizenship Behavior and Its Consequences for Customers of Foreign Household Appliance Products. Business

Management Outlook(49), 95-123. https://bar.yazd.ac.ir/m/article_2611.html?lang=en

Rezvani, M., Rezaei, M., & Tanha Pour, K. (2020). Customer Loyalty Model in Emerging Organizations Based on

Artificial Neural Networks; Case Study: Emerging Private Banks. Modern Marketing Research, 10(1), 63-82.

https://nmrj.ui.ac.ir/article_24686_en.html

Ringo, R. Y. S., Septyanto, D., & Ramli, A. H. (2023). Analysis of Factors Affecting Customer Satisfaction and Customer

Loyalty in the Shopee Marketplace. Majalah Ilmiah Bijak, 20(2), 293-310.

https://doi.org/10.31334/bijak.v20i2.3427

Riyath, M. I. M. (2024). Causal Factors of Customer Loyalty in Sri Lankan Banks.

https://doi.org/10.4038/sljmuok.v9i3.154

Saral, R., Salehzadeh, R., & Mirmehdi, S. M. (2024). Investigating the influence of service quality on loyalty in banking

industry: the role of customer engagement. International Journal of Services, Economics and Management, 15(1),

-18. https://doi.org/10.1504/IJSEM.2024.136057

Sarvari, P. A., Ustundag, A., & Takci, H. (2016). Performance evaluation of different customer segmentation approaches

based on RFM and demographics analysis. Kybernetes. https://doi.org/10.1108/K-07-2015-0180

Yahaya, R., Abisoye, O. A., & Bashir, S. A. (2021). An Enhanced Bank Customers Churn Prediction Model Using A

Hybrid Genetic Algorithm And K-Means Filter And Artificial Neural Network.2020 IEEE 2nd International

Conference on Cyberspace (CYBER NIGERIA)

Zheng, F., & Liu, Q. (2020). Anomalous telecom customer behavior detection and clustering analysis based on ISP's

operating data. IEEE Access, 8, 42734-42748. https://doi.org/10.1109/ACCESS.2020.2976898

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.