Designing a Model for National Banks’ Support to Foster Entrepreneurial Behavior in Small and Medium-Sized Enterprises

Keywords:

banking industry support, entrepreneurial behavior, small and medium-sized enterprises, mixed approachAbstract

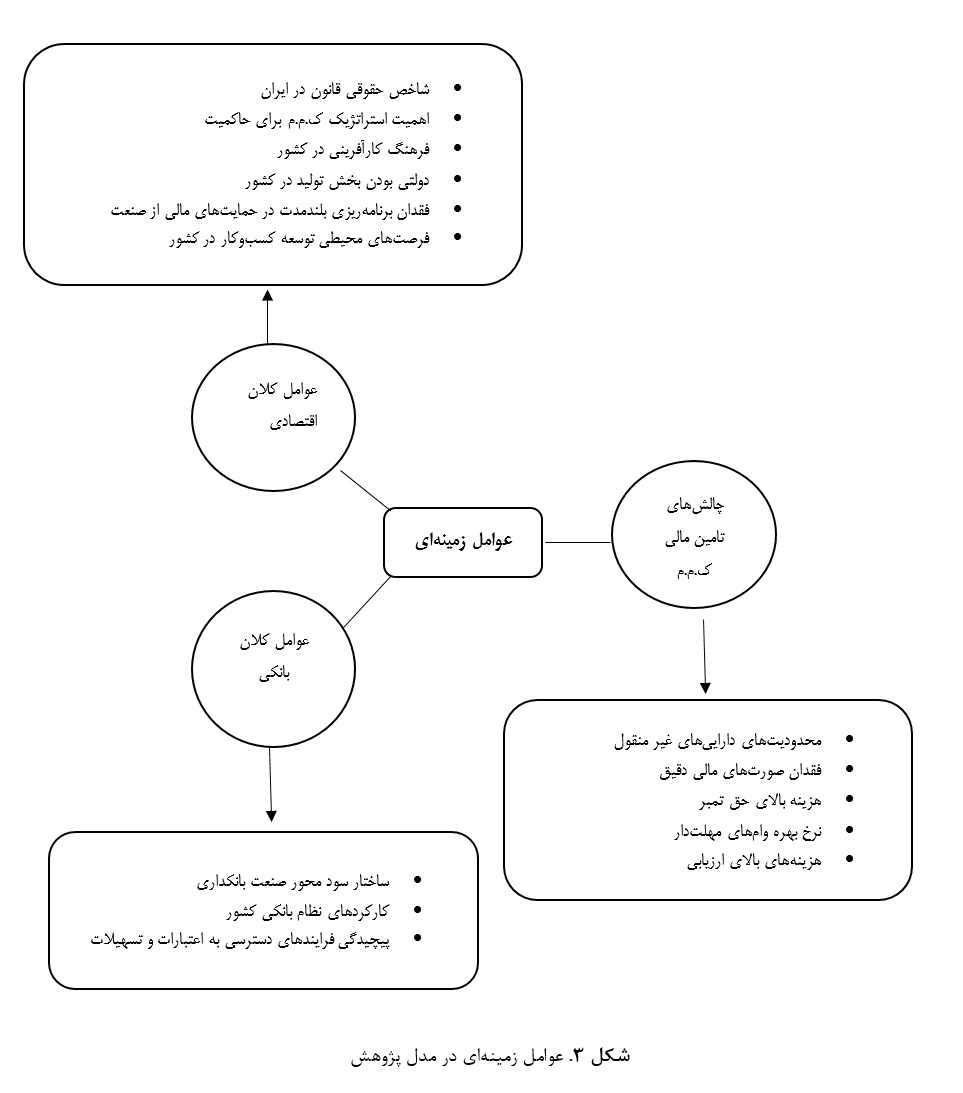

Small and medium-sized enterprises (SMEs) are considered the main drivers of economic development, and financial and technical support for them can have significant impacts on overall economic flows. Banks, as the primary arm for financing and credit provision to businesses, play an indispensable role in this regard. Thus, the primary objective of this study is twofold: first, to propose a model for national banks’ support aimed at fostering entrepreneurial behavior in SMEs, and second, to examine the significance and prioritization of key factors influencing banks' supportive role in developing entrepreneurial behavior in SMEs. To achieve this, the study utilized expert opinions from a panel of seven specialists in economics and banking from West Azerbaijan province for the qualitative section, and 464 managers from banks (specifically Sepah Bank) and SMEs in the province for the quantitative section. Data collection tools included semi-structured interviews for the qualitative phase and a researcher-made questionnaire for the quantitative phase. For data analysis and identifying influencing factors regarding banks' support for the development of entrepreneurial behavior in SMEs, thematic analysis and MAXQDA software were employed. Additionally, quantitative data analysis was conducted using structural equation modeling and AMOS software. The qualitative findings revealed that a total of 82 primary themes, organized into 14 organizing themes, can be identified in the context of banks' role in supporting the development of entrepreneurial behavior in SMEs. In the quantitative section, the significance and prioritization of causal, intervening, and contextual factors were examined. The results also demonstrated how the entrepreneurial behaviors of SMEs can either advance or stagnate based on banks' behaviors.

Downloads

References

Adam, N. A., & Alarifi, G. (2021). Innovation practices for survival of small and medium enterprises (SMEs) in the

COVID-19 times: the role of external support. Journal of Innovation and Entrepreneurship, 10(1), 151-170.

https://doi.org/10.1186/s13731-021-00156-6

Batrancea, L. M., Balcı, M. A., Chermezan, L., Akgüller, Ö., Masca, E. S., & Gaban, L. (2022). Sources of SMEs

Financing and Their Impact on Economic Growth across the European Union: Insights from a Panel Data Study

Spanning Sixteen Years. Sustainability, 14(22), 15318. https://doi.org/10.3390/su142215318

Cenamor, J., Parida, V., & Wincent, J. (2019). How entrepreneurial SMEs compete through digital platforms: The roles

of digital platform capability, network capability and ambidexterity. Journal of Business Research, 100, 196-206.

https://doi.org/10.1016/j.jbusres.2019.03.035

Crovini, C., Santoro, G., & Ossola, G. (2021). Rethinking risk management in entrepreneurial SMEs: towards the

integration with the decision-making process. Management Decision, 59(5), 1085-1113.

https://doi.org/10.1108/MD-10-2019-1402

Hanifzadeh, M., Nabati, Z., Longka, P., Malakul, P., Apul, D., & Kim, D. S. (2017). Life cycle assessment of superheated

steam drying technology as a novel cow manure management method. Journal of Environmental Management, 199,

-90. https://doi.org/10.1016/j.jenvman.2017.05.018

Jin, B., & Cho, H. J. (2018). Examining the role of international entrepreneurial orientation, domestic market competition,

and technological and marketing capabilities on SME's export performance. Journal of Business & Industrial

Marketing, 33(5), 585-598. https://doi.org/10.1108/JBIM-02-2017-0043

Kiger, M. E., & Varpio, L. (2020). Thematic analysis of qualitative data: AMEE Guide No. 131. Medical Teacher, 42(8),

-854. https://doi.org/10.1080/0142159X.2020.1755030

Kuratko, D. F., & Audretsch, D. B. (2013). Clarifying the domains of corporate entrepreneurship. International

Entrepreneurship and Management Journal, 9, 323-335. https://doi.org/10.1007/s11365-013-0257-4

Liñán, F., Paul, J., & Fayolle, A. (2020). SMEs and entrepreneurship in the era of globalization: advances and theoretical

approaches. Small Business Economics, 55, 695-703. https://doi.org/10.1007/s11187-019-00180-7

Ojeme, M., Robson, A., & Coates, N. (2018). Investigating the Nigerian small and medium enterprises (SMEs)-banking

long-term relationship building. International Journal of Bank Marketing, 36(1), 89-110.

https://doi.org/10.1108/IJBM-07-2016-0097

Sarwar, Z., Khan, M. A., Yang, Z., Khan, A., Haseeb, M., & Sarwar, A. (2021). An investigation of entrepreneurial

SMEs' network capability and social capital to accomplish innovativeness: a dynamic capability perspective. Sage

Open, 11(3), 21582440211036089. https://doi.org/10.1177/21582440211036089

Wang, X., Han, L., Huang, X., & Mi, B. (2021). The financial and operational impacts of European SMEs' use of trade

credit as a substitute for bank credit. The European Journal of Finance, 27(8), 796-825.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.