Identification of Criteria Affecting the Financial Performance of the Banking Industry to Support Small and Medium Enterprises (SMEs) with Emphasis on Entrepreneurship

Keywords:

Small and Medium Enterprises, Entrepreneurship, Banking Industry, Grounded TheoryAbstract

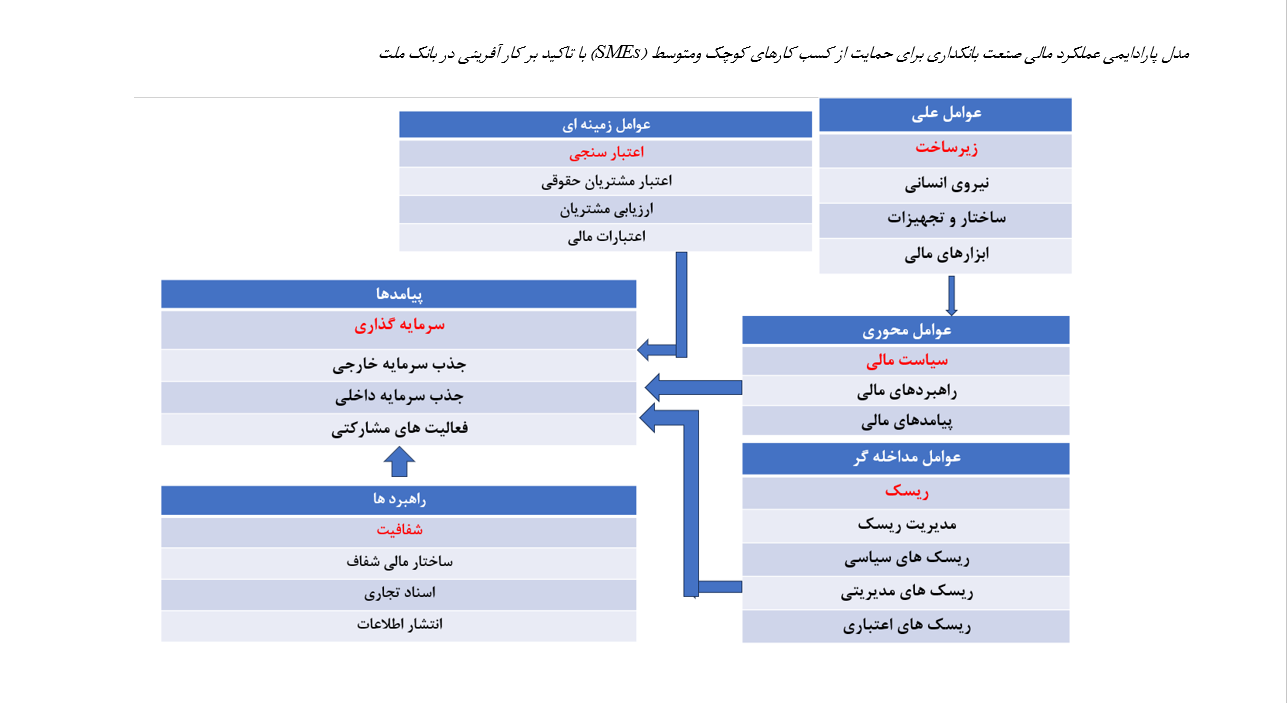

The aim of the present study is to identify the criteria affecting the financial performance of the banking industry in supporting small and medium enterprises (SMEs) with an emphasis on entrepreneurship. This research is applied in nature and qualitative in method. The statistical population comprised experts familiar with the research topic, including university professors in the fields of banking and entrepreneurship, as well as senior managers from Bank Mellat. The sampling was conducted theoretically, resulting in interviews with 12 experts until saturation was reached. The research approach was grounded theory, which involved interviews with experts and three types of coding: open, axial, and selective. Data collection was carried out through interviews with experts. To rank and categorize the factors, determine the types of variables, and examine the relationships between the model variables, as well as to assess the intensity of these relationships and identify the influence and dependency of the criteria, a combined ISM-DEMATEL method was employed. The results indicated that the main categories of the model include validation, infrastructure, financial policy, investment, risk, and transparency. Furthermore, based on the research findings, the first level includes risk management; the second level includes investment and financial transparency; the third level includes infrastructure; the fourth level includes validation; and the fifth level includes financial policies. The findings reveal that financial transparency, investment, and validation are connective factors, while infrastructure and risk are dependent factors, and financial policies are influential factors.

Downloads

References

Atsede, W., & Brychan, T. (2018). Financial Entrepreneurship for Economic Growth in Emerging Nations. IGI Global.

https://www.igi-global.com/book/financial-entrepreneurship-economic-growth-emerging/178208

Babayi Feshani, M., Khozin, A., Ziae, B., & Ashrafi, M. (2020). Designing a financial ecosystem model for technological

entrepreneurship in knowledge-based businesses (Case study: Information and communication technology sector).

Accounting and Auditing Research Journal, 12(48), 177-192. https://www.iaaaar.com/article_128234.html?lang=en

Covin, J. G., Rigtering, J. C., Hughes, M., Kraus, S., Cheng, C. F., & Bouncken, R. B. (2020). Individual and team

entrepreneurial orientation: Scale development and configurations for success. Journal of Business Research, 112,

-12. https://doi.org/10.1016/j.jbusres.2020.02.023

Dima, B., Lobonţ, O. R., & Moldovan, N. C. (2016). Does the quality of public policies and institutions matter for

entrepreneurial activity? Evidences from the European Union's member states. Panoeconomicus, 63(4), 425-439.

https://doi.org/10.2298/PAN1604425D

Ganjali, Z., & Bagheri, R. (2020). The impact of entrepreneurial orientation on entrepreneurial behavior with the

mediating role of entrepreneurial intention. Entrepreneurship Development Journal, 13(4), 521-540.

https://jed.ut.ac.ir/article_80505.html

Ghanbari, M., Zakeri, A., & Heidari-Dehouei, J. (2023). Determining the method of market entry for knowledge-based

companies into foreign markets using multi-criteria decision-making techniques. Scientific Research Journal of

International Business Management, 5(1), 123-146. https://www.sid.ir/paper/966379/en

Harisandi, P. (2024). Creation of Micro Market Structure in MSMEs in Review of Social Entrepreneurship Involvement,

Government Policy and Empowerment. Kontigensi Jurnal Ilmiah Manajemen, 12(1), 231-246.

https://doi.org/10.56457/jimk.v12i1.534

Joel, O. T. (2024). Entrepreneurial Leadership in Startups and SMEs: Critical Lessons From Building and Sustaining

Growth. International Journal of Management & Entrepreneurship Research, 6(5), 1441-1456.

https://doi.org/10.51594/ijmer.v6i5.1093

Khelil, N. (2015). The many faces of entrepreneurial failure: Insights from an empirical taxonomy. Journal of Business,

(5), 73-90. https://doi.org/10.1016/j.jbusvent.2015.08.001

Khoshtinat, M., Taghavi Fard, M., & Nobari, N. (2021). Financial performance analysis of private banks in the country.

Quarterly Journal of Financial and Islamic Banking Studies, 2(3), 113-138.

https://jifb.ibi.ac.ir/article_49422.html?lang=en

Kreiser, P. M., Kuratko, D. F., Covin, J. G., Ireland, R. D., & Hornsby, J. S. (2021). Corporate entrepreneurship strategy:

extending our knowledge boundaries through configuration theory. Small Business Economics, 56, 739-758.

https://doi.org/10.1007/s11187-019-00198-x

Le, T. T., & Ikram, M. (2022). Do sustainability innovation and firm competitiveness help improve firm performance?

Evidence from the SME sector in Vietnam. Sustainable Production and Consumption, 29, 588-599.

https://doi.org/10.1016/j.spc.2021.11.008

Meshulach, A., & Kedar-Levy, H. (2022). Resource Uncertainty and Sustainable Competitive Advantage: A Resource

Base Theory Perspective. SSRN. https://doi.org/10.2139/ssrn.4025177

Moradi, M., & Bayat, A. (2024). Designing a model of antecedents of organizational entrepreneurship using interpretive

structural modeling. Quarterly Journal of Innovation and Value Creation, 11(22), 185-204.

https://en.civilica.com/doc/1863918/

Oana-Ramona, L., Sorana, V., Alina, V., Florin, C., & Nicoleta-Claudia, M. (2021). The impact of good governance on

entrepreneurship in terms of sustainable development. In Contemporary Issues in Social Science (Vol. 106, pp. 307-

. Emerald Publishing Limited. https://doi.org/10.1108/S1569-375920210000106019

Ooghe, H., & De Prijcker, S. (2008). Failure processes and causes of company bankruptcy: a typology. Management

Decision, 46(2), 223-242. https://doi.org/10.1108/00251740810854131

Popa, S., Soto-Acosta, P., & Martinez-Conesa, I. (2017). Antecedents, moderators, and outcomes of innovation climate

and open innovation: An empirical study in SMEs. Technological Forecasting and Social Change, 118, 134-142.

https://doi.org/10.1016/j.techfore.2017.02.014

Pramono, R., Sondakh, L. W., Bernarto, I., Juliana, J., & Purwanto, A. (2021). Determinants of the small and medium

enterprises progress: A case study of SME entrepreneurs in Manado, Indonesia. The Journal of Asian Finance,

Economics and Business, 8(1), 881-889. https://www.semanticscholar.org/paper/Determinants-of-the-Small-andMedium-Enterprises-A-Pramono-Sondakh/949e1376e70ee678d8ce72fd6b831a22d501d953

Rezaei, R., & Hosseini, S. M. (2013). Designing a structural equation model for the development of organizational

entrepreneurship in rural development cooperatives of Zanjan Province. Entrepreneurship Development Quarterly

Journal, 6(4), 57-75. https://jed.ut.ac.ir/article_50798.html?lang=en

Riviere, M., & Romero-Martínez, A. M. (2021). Network embeddedness, headquarters entrepreneurial orientation, and

MNE international performance. International Business Review, 30(3).

https://doi.org/10.1016/j.ibusrev.2021.101811

Roy, P. K., & Shaw, K. (2021). A multicriteria credit scoring model for SMEs using hybrid BWM and TOPSIS. Financial

Innovation, 7(1), 77. https://doi.org/10.1186/s40854-021-00295-5

Sadegh Khani, S., & Ramazani, F. (2021). Credit risk and ranking of Bank Saderat Ilam customers using econometric

methods and logistic regression model. Eighth National Conference on Economics, Management, and Accounting,

Shirvan.

Sarwoko, E., & Frisdiantara, C. (2016). Growth determinants of small medium enterprises (SMEs). Universal Journal of

Management, 4(1), 36-41. https://doi.org/10.13189/ujm.2016.040105

Shababi, H. (2023). Presenting a model of factors influencing external financing for innovation in small and medium

enterprises using meta-synthesis methodology. Science and Technology Policy Quarterly, 12(2), 25-44.

https://stpl.ristip.sharif.ir/article_22408.html?lang=en

Shiyuti, H. A., Zainol, F. A., & Ishak, M. S. I. (2021). Why business fail? A thematic review analysis on SMEs. The

Journal of Management Theory and Practice (Jmtp), 2(2), 1-11. https://doi.org/10.37231/jmtp.2021.2.2.98

Sojoudi, S., & Jalili, A. (2023). Islamic financing for small and medium-sized enterprises: Challenges and solutions.

Scientific Quarterly of Islamic Economics and Banking(39), 33-53. https://mieaoi.ir/article-1-1274-en.html

Tamizifar, M., Tohidi, M., & Shokri, M. (2023). Identifying and prioritizing strategies to improve access of small and

medium enterprises to banking services in Iran. Entrepreneurship Development Journal, 15(4), 627-639.

https://jed.ut.ac.ir/article_89931.html?lang=en

Wales, W., Gupta, V. K., Marino, L., & Shirokova, G. (2019). Entrepreneurial orientation: International, global and

cross-cultural research. International Small Business Journal, 37(2), 95-104.

https://doi.org/10.1177/0266242618813423

Zimmermann, V. (2020). Innovation and Investment Finance in Comparison. In Contemporary Developments in

Entrepreneurial Finance: An Academic and Policy Lens on the Status-Quo, Challenges and Trends (pp. 59-79).

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.