Designing a Model for the Adoption of Generative Artificial Intelligence in the Iranian Banking Industry

Keywords:

Generative Artificial Intelligence, Iranian Banking Industry, Thematic Analysis, Interpretive Structural Modeling (ISM), Digital Value CreationAbstract

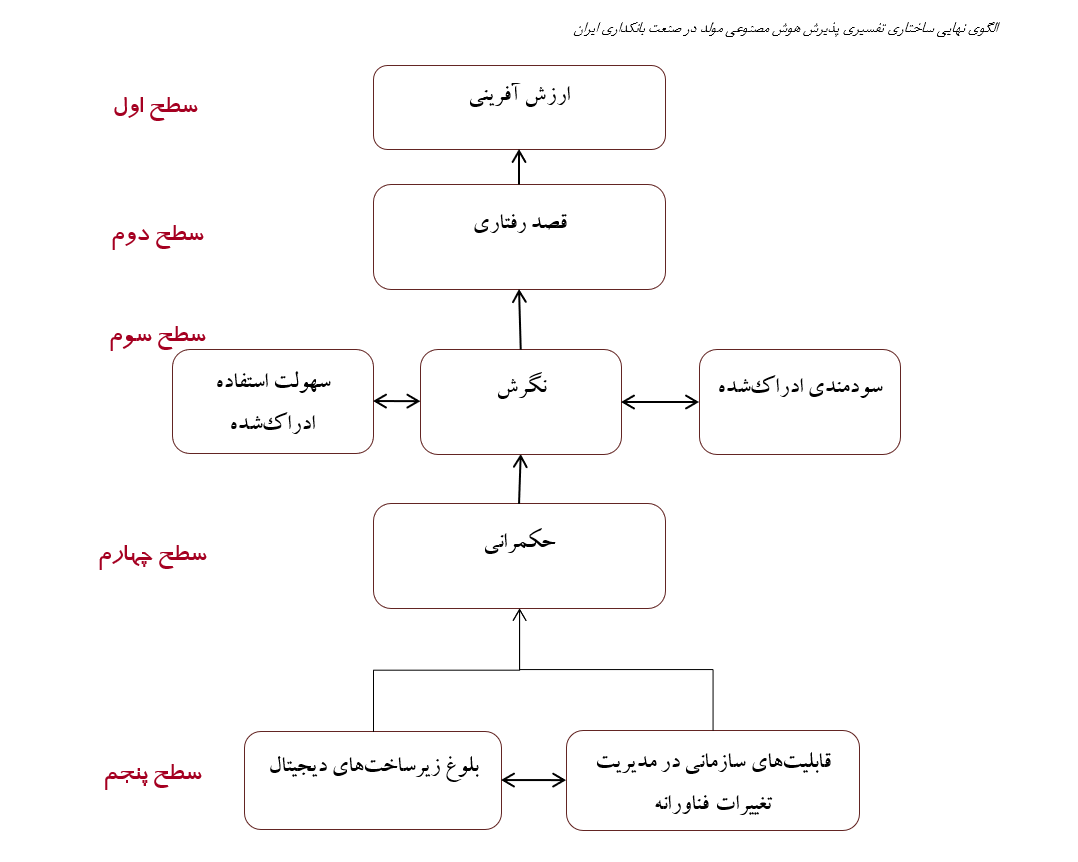

The study aimed to design a conceptual model for the adoption of generative artificial intelligence (AI) in the Iranian banking industry using thematic analysis and interpretive structural modeling (ISM). This applied research employed an exploratory mixed-method design. In the qualitative phase, data were collected through semi-structured interviews with 13 experts in management, IT, and banking, selected purposefully until theoretical saturation. Thematic analysis was used to extract core, organizing, and overarching themes. In the quantitative phase, the identified dimensions were structured and ranked through the ISM technique using Micmac software to determine the hierarchical relationships among the factors. The thematic analysis revealed 81 basic themes grouped into 20 organizing and 8 overarching themes: digital infrastructure maturity, organizational capabilities in managing technological change, governance, value creation, behavioral intention, perceived ease of use, perceived usefulness, and attitude. ISM analysis indicated that digital infrastructure maturity and organizational capability form the foundational layer, governance occupies the intermediate layer, and value creation represents the ultimate outcome of AI adoption. Behavioral intention emerged as a linking construct mediating between perception-based factors and organizational outcomes. Successful adoption of generative AI in Iranian banking requires a synergistic alignment of technological, organizational, and human dimensions. Enhanced digital infrastructure, effective governance, and positive user attitudes constitute the essential enablers for achieving operational efficiency, customer experience enhancement, and sustainable competitive advantage.

Downloads

References

Aghamohammadi, H., & Enayati Hatke Loui, H. (2024). Identifying human capital challenges in Banking 4.0 influenced by artificial intelligence advancements: A meta-synthesis study. Strategic Financial and Banking Studies, 2(2), 98–114. https://www.journal-fbs.com/article_201217.html

Bai, X., Zhuang, S., Xie, H., & Guo, L. (2024). Leveraging generative artificial intelligence for financial market trading data management and prediction. Preprints. https://doi.org/10.20944/preprints202407.0084.v1

Balaji, K. (2024). Harnessing AI for Financial Innovations: Pioneering the Future of Financial Services. In Modern Management Science Practices in the Age of AI (pp. 91–122). IGI Global. https://doi.org/10.4018/979-8-3693-6720-9.ch004

Botunac, I., Parlov, N., & Bosna, J. (2024). Opportunities of Gen AI in the Banking Industry with regards to the AI Act, GDPR, Data Act and DORA.

Chakraborty, U., Roy, S., & Kumar, S. (2023). Rise of Generative AI and ChatGPT: Understand how Generative AI and ChatGPT are transforming and reshaping the business world. BPB Publications.

Gallego-Gomez, C., & De-Pablos-Heredero, C. (2020). Artificial intelligence as an enabling tool for the development of dynamic capabilities in the banking industry. International Journal of Enterprise Information Systems (IJEIS), 16(3), 20–33. https://doi.org/10.4018/IJEIS.2020070102

Gupta, V., & Yang, H. (2024). Generative artificial intelligence (AI) technology adoption model for entrepreneur: Case of ChatGPT. https://doi.org/10.1080/10875301.2023.2300114

Kate, P., Ravi, V., & Gangwar, A. (2022). Fingan: Generative adversarial network for analytical customer relationship management in banking and insurance. arXiv preprint arXiv:2201.11486. https://doi.org/10.1007/s00521-022-07968-x

Kate, P., Ravi, V., & Gangwar, A. (2023). FinGAN: Chaotic generative adversarial network for analytical customer relationship management in banking and insurance. Neural Computing and Applications, 35(8), 6015–6028. https://doi.org/10.1007/s00521-022-07968-x

Kheradmmandnia, S., & Taghizadeh, M. (2024). Generative artificial intelligence: Challenges and requirements for development and implementation. https://report.mrc.ir/article_10243.html

Kshetri, N., Dwivedi, Y. K., Davenport, T. H., & Panteli, N. (2024). Generative artificial intelligence in marketing: Applications, opportunities, challenges, and research agenda. International Journal of Information Management, 75. https://doi.org/10.1016/j.ijinfomgt.2023.102716

Liu, S., Li, G., & Xia, H. (2021). Analysis of Talent Management in the Artificial Intelligence Era. https://doi.org/10.2991/aebmr.k.210218.007

Mahida, A. (2023). Explainable Generative Models in FinCrime. Journal of Artificial Intelligence, Machine Learning & Data Science, 1(2), 205–208. https://doi.org/10.51219/JAIMLD/ankur-mahida/69

Mahmoudi Meymand, M., & Mohseni Fard, N. (2024). The effect of generative artificial intelligence adoption on organizational performance in small and medium-sized enterprises. Journal of New Research Approaches in Management and Accounting, 8(28), 2449–2463. https://majournal.ir/index.php/ma/article/view/2662

Mousavi, S. R., & Abedian Azarkhvarani, N. (2023). The impact of artificial intelligence and metaverse innovations on modern banking. Journal of New Research Approaches in Management and Accounting, 7(26), 1389–1405. https://majournal.ir/index.php/ma/article/view/2197

Nasr Esfahani, M., Ghaemi Asl, M., Montazer, R., & Esmaeili, M. (2025). The role of artificial intelligence enabling capabilities in enhancing supervisory performance of Iran's banking system. Country Studies, 3(4), 713–753. https://doi.org/10.22059/jcountst.2025.388154.1218

Nazarpour, M., Nasl Mousavi, S. H., & Hosseini Shirvani, M. S. (2020). Application of artificial intelligence in tax auditing. Auditing Knowledge, 20(81), 198–226. https://sid.ir/paper/967020/fa

Ooi, K. B., Tan, G. W. H., Al-Emran, M., Al-Sharafi, M. A., Capatina, A., Chakraborty, A., & Wong, L. W. (2023). The potential of generative artificial intelligence across disciplines: Perspectives and future directions. Journal of Computer Information Systems, 1–32. https://doi.org/10.1080/08874417.2023.2261010

Paramesha, M., Rane, N. L., & Rane, J. (2024). Artificial intelligence, machine learning, deep learning, and blockchain in financial and banking services: A comprehensive review. Partners Universal Multidisciplinary Research Journal, 1(2), 51–67. https://doi.org/10.2139/ssrn.4855893

Patil, D., Rane, N. L., & Rane, J. (2024). Acceptance of ChatGPT and generative artificial intelligence in several business sectors: Key factors, challenges, and implementation strategies. In. https://doi.org/10.70593/978-81-981367-8-7_5

Rahman, M., Ming, T. H., Baigh, T. A., & Sarker, M. (2023). Adoption of artificial intelligence in banking services: an empirical analysis. International Journal of Emerging Markets, 18(10), 4270–4300. https://doi.org/10.1108/IJOEM-06-2020-0724

Rane, J., Kaya, Ö., Mallick, S. K., & Rane, N. L. (2024). Generative Artificial Intelligence in Agriculture, Education, and Business. Deep Science Publishing. https://doi.org/10.70593/978-81-981271-7-4

Rodrigues, A. R. D., Ferreira, F. A., Teixeira, F. J., & Zopounidis, C. (2022). Artificial intelligence, digital transformation and cybersecurity in the banking sector: A multi-stakeholder cognition-driven framework. Research in International Business and Finance, 60, 101616. https://doi.org/10.1016/j.ribaf.2022.101616

Saghafi, A., & Parsapour, M. R. (2025). Investigating the impact of accounting data analysis using generative artificial intelligence on the quality of digital sustainability reporting considering the mediating role of green sustainability internal control systems. Financial Accounting Knowledge, 12(1), 1–31. https://doi.org/10.30479/jfak.2025.21533.3270

Samala, A. D., Rawas, S., Wang, T., Reed, J. M., Kim, J., Howard, N. J., & Ertz, M. (2024). Unveiling the landscape of generative artificial intelligence in education: a comprehensive taxonomy of applications, challenges, and future prospects. Education and Information Technologies, 1–40. https://doi.org/10.1007/s10639-024-12936-0

Thamma, S. R. (2024). An Experimental Analysis of Revolutionizing Banking and Healthcare with Generative AI. https://philarchive.org/archive/THAAEA-3

Tong, H. H., & Lim, M. (2024). The Potential for Artificial Intelligence to Address Challenges Faced by Custodian Banks. https://doi.org/10.69554/IODC6478

Vucinic, M., & Luburic, R. (2024). Artificial Intelligence, Fintech and Challenges to Central Banks. Journal of Central Banking Theory and Practice. https://doi.org/10.2478/jcbtp-2024-0021

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Roohollah Joghtaie, Majid Nasiri, Elahe Masoumi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.