The Moderating Pattern of the Life Cycle on the Relationship between Market Timing and Market Status on Stock Issuance Decisions with an Organic Approach Theory

Keywords:

Life Cycle, Market Timing Regime, Market Status, Stock Issuance, Organic ApproachAbstract

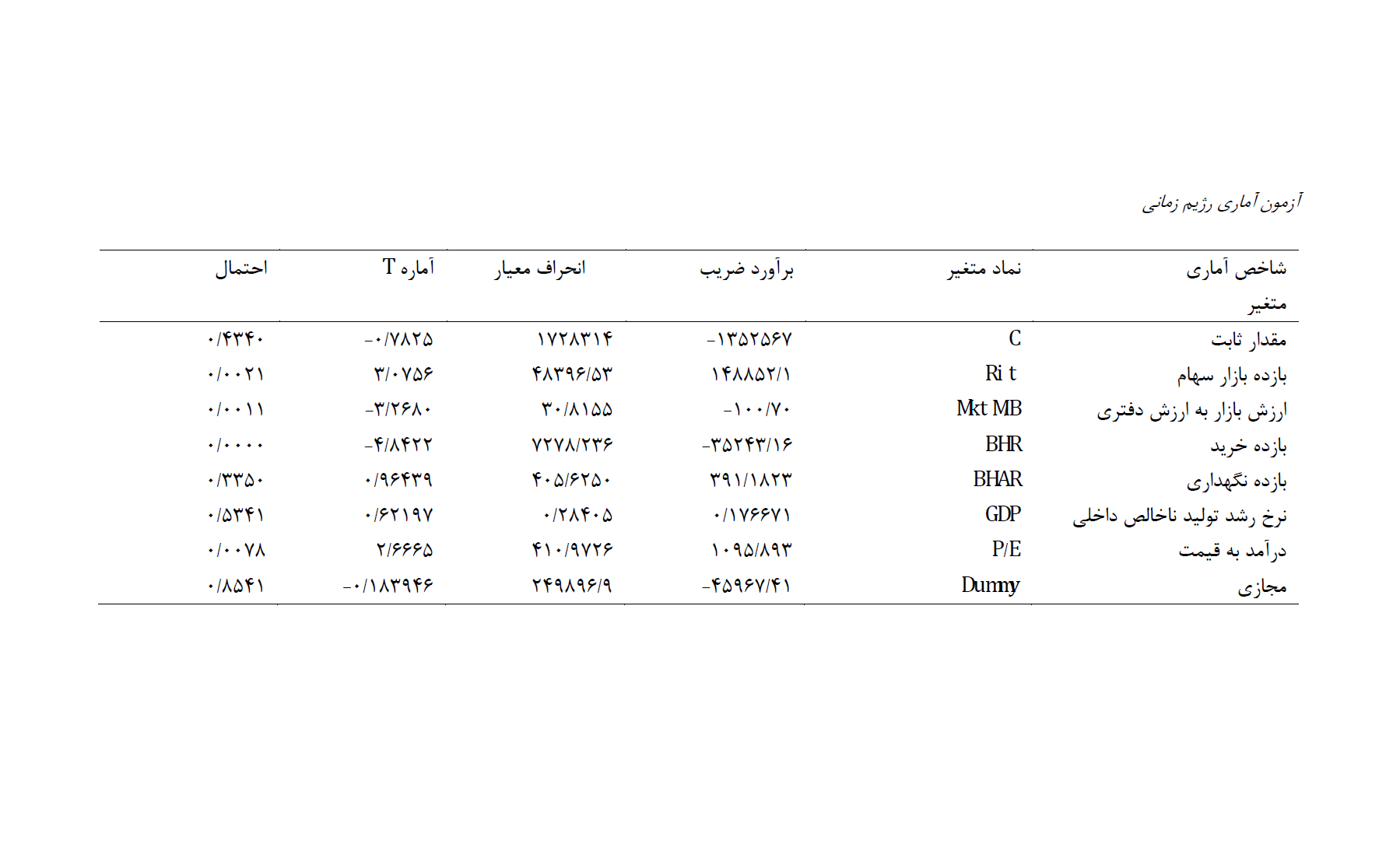

One of the features of today's markets is the focus on factors influencing stock issuance in competitive markets. The necessity of this matter lies in having comprehensive awareness of the company's position in financial markets and the surrounding environment affecting company performance. This research aims to examine the moderating pattern of the life cycle on the relationship between market timing and market status on stock issuance decisions, adopting an organic approach theory. For this purpose, 120 companies listed on the Tehran Stock Exchange were selected as the sample. To analyze the data, combined methods were used, and the regression model was estimated using Eviews7 software. The research findings indicate that there is a direct and significant relationship between the variables of stock market return, earnings to price ratio, and net cash flows minus paid dividends. Additionally, there is an inverse and significant relationship between the market value to book value ratio, buyback returns, and net cash flows minus paid dividends. However, there is no significant relationship between the variables of stock holding returns and the GDP growth rate and net cash flows minus paid dividends. The findings also show that companies in the maturity stage issue more stocks compared to other stages of the life cycle. This suggests that companies in the maturity stage have high levels of accessible capital, which can position them to attract more investments.

Downloads

References

Anthony, J. H., & Ramesh, K. (1992). Association between accounting performance measures and stock prices: A test

of the life cycle hypothesis. Journal of Accounting and Economics, 15(2), 203-227.

https://www.sciencedirect.com/science/article/pii/016541019290018W

Baker, M., & Wurgler, J. (2002). Market Timing and Capital Structure. The Journal of Finance, 57(1), 1-32.

https://doi.org/10.1111/1540-6261.00414

Huang, Y., Uchida, K., & Zah, D. (2016). Market timing in private placements of equity. Available at SSRN 2904861.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2904861

Kashanipour, M., Karimi, H., & Karimi, V. (2015). 8) The Relation of Ownership and board Structure with Voluntary

Disclosure. Empirical Research in Accounting, 4(4), 167-186. https://doi.org/10.22051/jera.2015.1908

MohammadAli, K. (2008). A Comprehensive Trend of Capital Structure Case Study of Companies Listed In TSE.

Financial Research Journal, 10(25). https://jfr.ut.ac.ir/article_27747.html

Moradi, J., Valipour, h., & Salehi, m. (2016). The Relevance of Intangible Assets Considering Firm's Life Cycle.

Empirical Research in Accounting, 6(1), 1-14. https://doi.org/10.22051/jera.2016.650

Rezaei, F., & Samani, K. (2014). The Effects of a Firm Life Cycle and Size on its Priority of External Financing

Alternatives. Financial Accounting Research, 6(2), 95-114. https://far.ui.ac.ir/article_17015.html

Titman, S., & Wessels, R. (1988). The Determinants of Capital Structure Choice. The Journal of Finance, 43(1), 1-19.

https://doi.org/10.1111/j.1540-6261.1988.tb02585.x

Wadhwa, K., & Syamala, S. R. (2019). Role of market timing and market conditions: Evidence from seasoned equity

offerings. The North American Journal of Economics and Finance, 48, 555-566.

https://www.sciencedirect.com/science/article/pii/S1062940817303625

Yan, Z., & Zhao, Y. (2009). A new methodology of measuring firm life-cycle stages. International Journal of Economic

Perspectives, Forthcoming. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=893826

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.