Predicting Corporate Financial Distress Using a Hybrid Model of Artificial Immune System and Wavelet Neural Network (Artificial Intelligence)

Keywords:

Financial Distress, Financial Prediction, Wavelet Neural Network, Artificial Immune System, Logistic Regression, Hybrid AlgorithmAbstract

In today's financial landscape, the prediction of corporate financial distress plays a crucial role in risk management and economic stability. This study aims to develop a hybrid predictive model that combines the Artificial Immune System (AIS) with the Wavelet Neural Network (WNN) to forecast financial distress in companies. The hybrid model leverages the strengths of both algorithms to improve accuracy in identifying distressed firms based on financial data. Utilizing a dataset of Tehran Stock Exchange-listed companies, this research compares the performance of the hybrid model against traditional methods like logistic regression and standalone neural networks. Results demonstrate that the AIS-WNN hybrid model outperforms other techniques in terms of prediction accuracy, sensitivity, and overall robustness. The findings indicate that the proposed model provides a powerful tool for investors, auditors, and policymakers to anticipate financial distress and make informed decisions. This approach can be further expanded to other domains of financial forecasting, contributing to the advancement of predictive analytics in the field.

Downloads

References

Abdolrazagh Nejad Majid, M., & Adibian, A. (2020). Dimension reduction of feature based on Rafe's theory using

football league competition algorithm. https://www.sid.ir/paper/409306/fa

Alavi, M., & Memarian, H. (2021). Auditor characteristics and the likelihood of bankruptcy. Experimental Accounting

Research, 11(2), 159-182. https://jera.alzahra.ac.ir/article_5568.html?lang=fa

Ali Akbarloo, A., Mansourfar, G., & Ghiyour, A. (2020). Comparison of criteria for detecting financially distressed

companies using logistic regression and artificial intelligence methods. Financial Management Outlook, 10(29),

-166. https://doi.org/10.52547/jfmp.10.29.147

Azizi, H. (2021). Modeling and determining the capability of working capital management in predicting corporate

bankruptcy using artificial intelligence algorithms. Securities Analysis Financial Knowledge, 14(51), 171-190.

https://journals.srbiau.ac.ir/article_19258.html

Baghbid, E., Jafari, A., & Salehnejad, S. H. (2021). Proposing a three-dimensional (financial, economic, sustainability)

combined model for predicting corporate financial distress. Research in Financial Accounting and Auditing, 13(51),

-132. https://journals.iau.ir/article_686544.html

Dong, X., Dang, B., Zang, H., Li, S., & Ma, D. (2024). The prediction trend of enterprise financial risk based on machine

learning arima model. Journal of Theory and Practice of Engineering Science, 4(01), 65-71.

https://www.centuryscipub.com/index.php/jtpes/article/view/430

Fereidoni, F., Darabi, R., & Anvari Rastami, A. (2020). Application of artificial intelligence algorithms in predicting

earnings smoothing. Research in Financial Accounting and Auditing, 12(45), 103-134.

https://ensani.ir/fa/article/479271/

Halteh, K., Alkhouri, R., Ziadat, S., & Haddad, F. (2024). Fintech Unicorns Forecaster: An AI Approach For Financial

Distress Prediction. Migration Letters, 21(S4), 942-954.

https://migrationletters.com/index.php/ml/article/download/7379/4801/19544

Haroonkalaei, K., & Barzegar, A. (2023). Explanation of financial variables affecting the prediction of financial recovery:

An artificial intelligence approach. Economic Modeling Scientific Journal, 17(61).

https://journals.iau.ir/article_703693.html

Qatabi, M., Khodadadi, V., Jerjerzadeh, & Kaab Omir, A. (2020). Modeling bankruptcy prediction using earnings

management variables. Economic Modeling, 14(50), 131-152.

https://ensani.ir/fa/article/439378/%D9%85%D8%AF%D9%84-%D8%B3%D8%A7%D8%B2%DB%8C-

%D9%BE%DB%8C%D8%B4-%D8%A8%DB%8C%D9%86%DB%8C-

%D9%88%D8%B1%D8%B4%DA%A9%D8%B3%D8%AA%DA%AF%DB%8C-%D8%A8%D8%A7-

%D8%A7%D8%B3%D8%AA%D9%81%D8%A7%D8%AF%D9%87-%D8%A7%D8%B2-

%D9%85%D8%AA%D8%BA%DB%8C%D8%B1%D9%87%D8%A7%DB%8C-

%D9%85%D8%AF%DB%8C%D8%B1%DB%8C%D8%AA-%D8%B3%D9%88%D8%AF

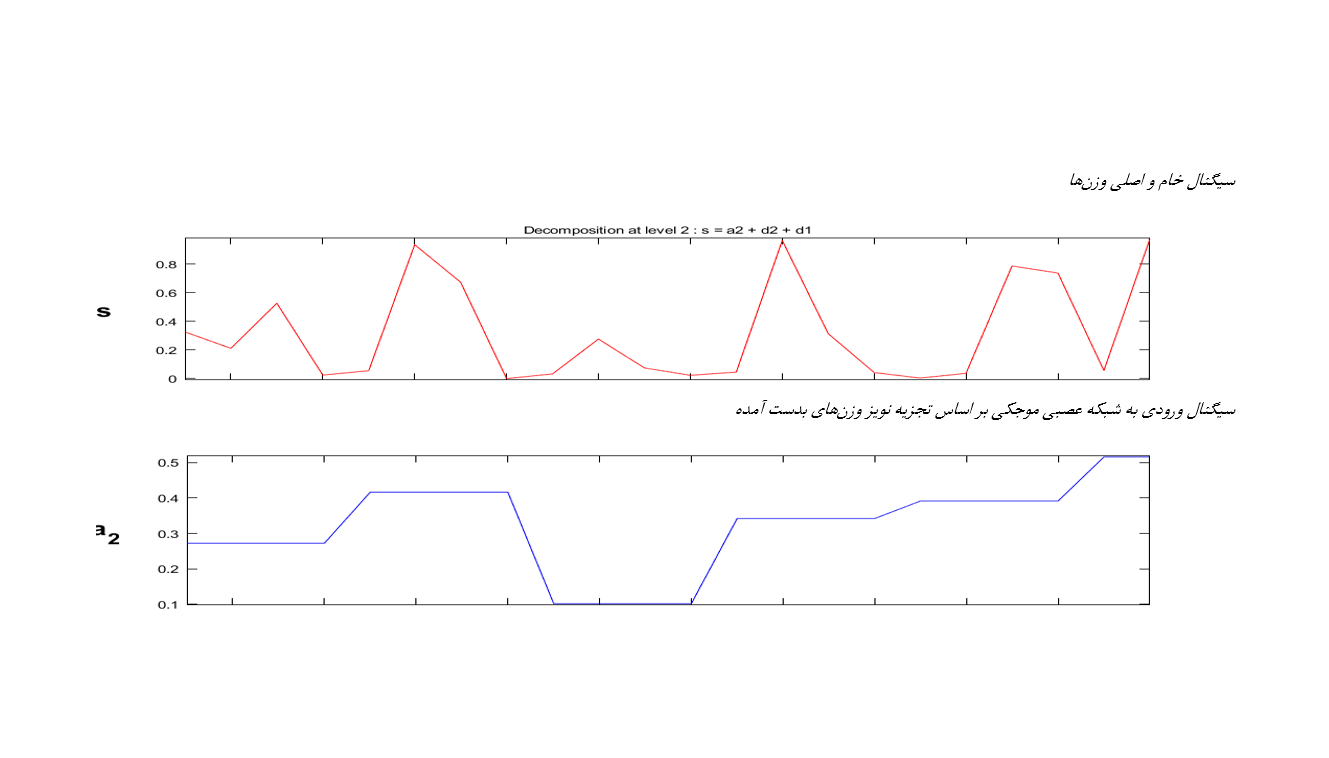

Sadeghi, H., & Zolfaghari, M. (2010). Short-term prediction of national electricity demand using neural networks and

wavelet transform. https://civilica.com/doc/1821120/

Sheikhivand Subhan, S., & Qayemi Saharaneh, S. (2019). Automatic identification of sleep stages from single-channel

EEG signals using discrete wavelet transform and a combined model of ant colony algorithm and RUSBoost-based

neural network classifier. https://www.ijbme.org/article_36377.html

Song, Y., Jiang, M., Li, S., & Zhao, S. (2024). Class‐imbalanced financial distress prediction with machine learning:

Incorporating financial, management, textual, and social responsibility features into index system. Journal of

Forecasting, 43(3), 593-614. https://doi.org/10.1002/for.3050

Soydas, S. S., & Handan, C. A. M. (2024). Predicting Financial Failure in Companies by Employing Machine Learning

Methods. International Journal of Social Science Research and Review, 7(2), 111-125.

https://ijssrr.com/journal/article/view/1827

Vali Zadeh Larijani, A., & Bani Mahd, M. (2022). Financial statement items, life cycle, and corporate bankruptcy.

Experimental Accounting Research, 12(2), 91-110. https://jera.alzahra.ac.ir/article_6376.html

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.