Optimizing Bank Profitability Model Considering the Role of Modern Banking Technologies

Keywords:

Bank Optimization, Bank Profitability, Modern Banking Technologies, FintechAbstract

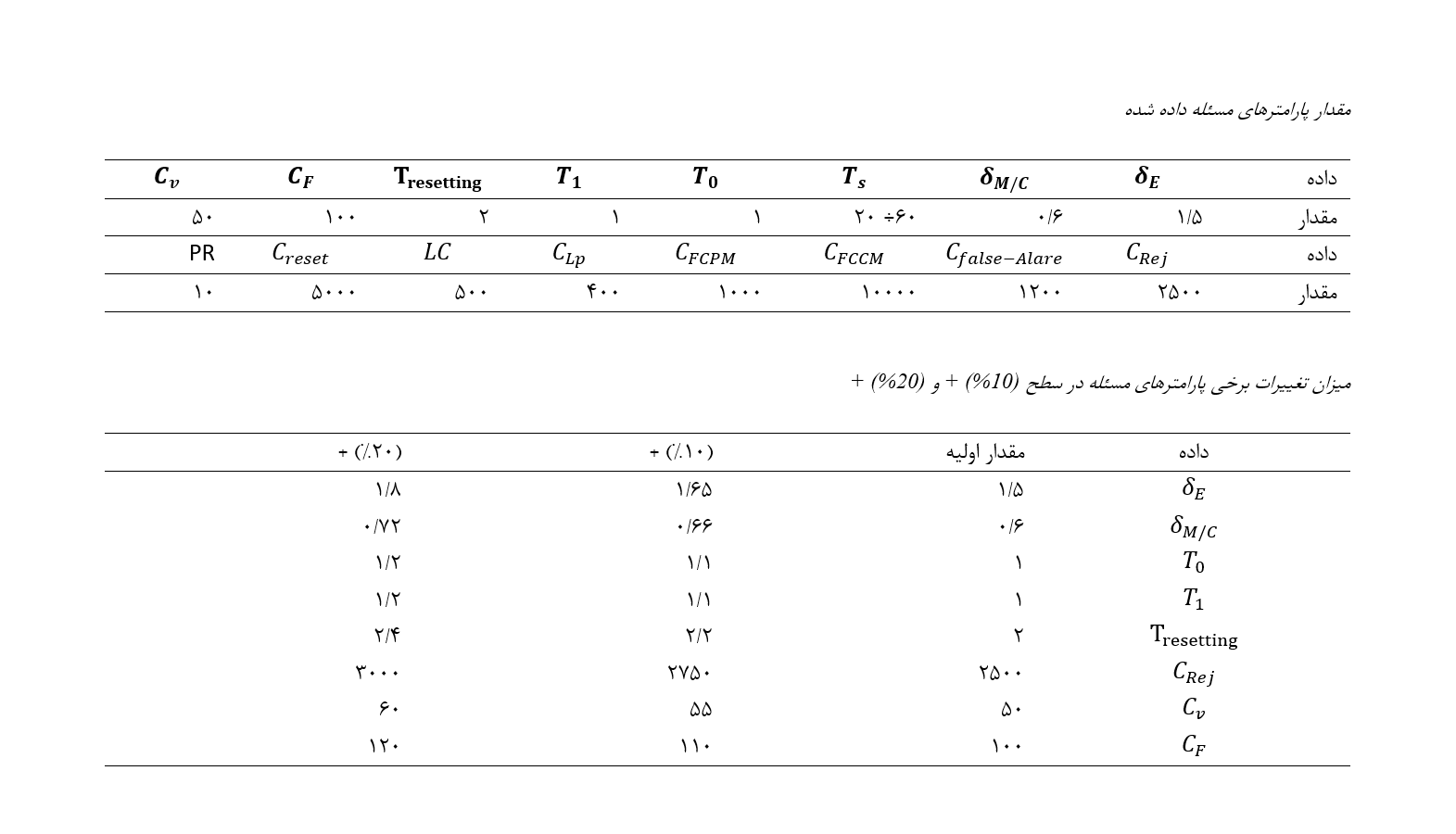

The aim of this study is to present an optimized model for bank profitability by considering the role of modern banking technologies. This research, being exploratory in nature due to its model development, is also considered applied because its results are utilized by beneficiaries. A quantitative method is used in this study to optimize bank profitability while considering the role of modern banking technologies. In the first step, influential components are identified through library techniques and document review, followed by mathematical programming for modeling. The proposed model is optimized using the epsilon-constraint algorithm in the MAPLE software and further optimized using MATLAB software. The research population, as a case study, includes documents and articles related to the banking industry. Initially, a single-component bank, considered as part of the system, was examined. Assume the bank operates in a seven-hour shift, six days a week. The maintenance activity time and fintech interventions were set to 7 time units, and the service delivery and corrective actions were set to 12 time units. With a 10% and 20% increase in the δ_E and δ_(M/C) data, significant changes in the objective function and decision variables were observed. However, changes in other data did not result in noticeable alterations in the model, indicating the importance of preventing the process from shifting to an out-of-control state and the significance of changes in the mean and standard deviation of the targeted quality characteristic. The proposed model determines the optimal value of each of the four decision variables: sample size (n), sampling interval (h), control limit coefficient (k), and intervals for preventive fintech actions (t_PM), which minimizes the total expected cost from integration per time unit. A numerical example demonstrated the economic impact of cost parameters on the integrated policy of profit control and preventive fintech actions. Additionally, in this study, the integrated model was compared with the independent model through a numerical example, and the significant difference in total cost highlighted the superiority of the integrated model over the independent model.

Downloads

References

Adalessossi, K. (2023). Impact of E-Banking on the Islamic bank profitability in Sub-Saharan Africa: What are the

financial determinants? Finance Research Letters, 57. https://doi.org/10.1016/j.frl.2023.104188

Alaassar, A., Mention, A.-L., & Aas, T. H. (2023). Facilitating innovation in FinTech: A review and research agenda.

Review of managerial science, 17, 33-66. https://doi.org/10.1007/s11846-022-00531-x

Chen, Y., Mandler, T., & Meyer-Waarden, L. (2021). Three decades of research on loyalty programs: A literature review

and future research agenda. Journal of Business Research, 124, 179-197.

https://doi.org/10.1016/j.jbusres.2020.11.057

Guang-Wen, Z., & Siddik, A. B. (2023). The effect of Fintech adoption on green finance and environmental performance

of banking institutions during the COVID-19 pandemic: The role of green innovation. Environmental Science and

Pollution Research, 30, 25959-25971. https://doi.org/10.1007/s11356-022-23956-z

Haddad, C., & Hornuf, L. (2022). How do fintech startups affect financial institutions' performance and default risk?

European Journal of Finance, 29, 1761-1792. https://doi.org/10.1080/1351847X.2022.2151371

Hoang, T. G., Nguyen, G. N. T., & Le, D. A. (2022). Developments in financial technologies for achieving the sustainable

development goals (SDGs): FinTech and SDGs. In Disruptive Technologies and Eco-Innovation for Sustainable

Development (pp. 1-19). IGI Global. https://doi.org/10.4018/978-1-7998-8900-7.ch001

Isayas, Y. N. (2022). Determinants of banks' profitability: Empirical evidence from banks in Ethiopia. Cogent Economics

& Finance, 10. https://doi.org/10.1080/23322039.2022.2031433

Katsiampa, P., McGuinness, P. B., Serbera, J.-P., & Zhao, K. (2022). The financial and prudential performance of

Chinese banks and Fintech lenders in the era of digitalization. Review of Quantitative Finance and Accounting, 58,

-1503. https://doi.org/10.1007/s11156-021-01033-9

Klein, P.-O., & Weill, L. (2022). Bank profitability and economic growth. The Quarterly Review of Economics and

Finance, 84, 183-199. https://doi.org/10.1016/j.qref.2022.01.009

Li, E., Mao, M. Q., Zhang, H. F., & Zheng, H. (2023). Banks' investments in fintech ventures. Journal of Banking and

Finance, 149. https://doi.org/10.1016/j.jbankfin.2022.106754

Li, L., Gao, W., & Gu, W. (2023). Fintech, bank concentration and commercial bank profitability: Evidence from Chinese

urban commercial banks. Finance Research Letters, 57. https://doi.org/10.1016/j.frl.2023.104234

Milojević, N., & Redzepagic, S. (2021). Prospects of Artificial Intelligence and Machine Learning Application in

Banking Risk Management. Journal of Central Banking Theory and Practice, 10, 41-57.

https://doi.org/10.2478/jcbtp-2021-0023

Mitra, S., & Karathanasopoulos, A. (2020). FinTech revolution: The impact of management information systems upon

relative firm value and risk. Journal of Banking and Financial Technology, 4, 175-187.

https://doi.org/10.1007/s42786-020-00023-0

Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking:

Opportunities and risks. International Review of Financial Analysis, 81. https://doi.org/10.1016/j.irfa.2022.102103

Nguyen, L., Tran, S., & Ho, T. (2021). Fintech credit, bank regulations and bank performance: A cross-country analysis.

Asia-Pacific Journal of Business Administration, 14, 445-466. https://doi.org/10.1108/APJBA-05-2021-0196

Phan, D. H. B., Narayan, P. K., Rahman, R. E., & Hutabarat, A. R. (2020). Do financial technology firms influence bank

performance? Pacific Basin Finance Journal, 62. https://doi.org/10.1016/j.pacfin.2019.101210

Rabbani, M. R., Bashar, A., Hawaldar, I. T., Shaik, M., & Selim, M. (2022). What Do We Know about Crowdfunding

and P2P Lending Research? A Bibliometric Review and Meta-Analysis. Journal of Risk and Financial Management,

(451). https://doi.org/10.3390/jrfm15100451

Riikkinen, M., & Pihlajamaa, M. (2022). Achieving a strategic fit in fintech collaboration-A case study of Nordea Bank.

Journal of Business Research, 152, 461-472. https://doi.org/10.1016/j.jbusres.2022.05.049

Safiullah, M., & Paramati, S. R. (2022). The impact of FinTech firms on bank financial stability. Electronic Commerce

Research. https://doi.org/10.1007/s10660-022-09595-z

Sidaoui, M., Bouheni, F. B., Arslankhuyag, Z., & Mian, S. (2022). Fintech and Islamic banking growth: New evidence.

The Journal of Risk Finance, 23, 535-557. https://doi.org/10.1108/JRF-03-2022-0049

Sun, Y., Li, S., & Wang, R. (2023). Fintech: From budding to explosion-an overview of the current state of research.

Review of managerial science, 17, 715-755. https://doi.org/10.1007/s11846-021-00513-5

Tarawneh, A., Abdul-Rahman, A., Mohd Amin, S. I., & Ghazali, M. F. (2024). A Systematic Review of Fintech and

Banking Profitability. International Journal of Financial Studies, 12(3). https://doi.org/10.3390/ijfs12010003

Wang, X., Sadiq, R., Khan, T. M., & Wang, R. (2021). Industry 4.0 and intellectual capital in the age of FinTech.

Technological Forecasting and Social Change, 166. https://doi.org/10.1016/j.techfore.2021.120598

Yao, T., & Song, L. (2021). Examining the differences in the impact of Fintech on the economic capital of commercial

banks' market risk: Evidence from a panel system GMM analysis. Applied Economics, 53, 2647-2660.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.